Update: Offer further extended till 30th June 2019

American Express India has been quite aggressive on supplementary card offers since past one year. The best one was during early 2018 that gave upto sweet 5K MR Points per Supp. Card, but that eventually ended.

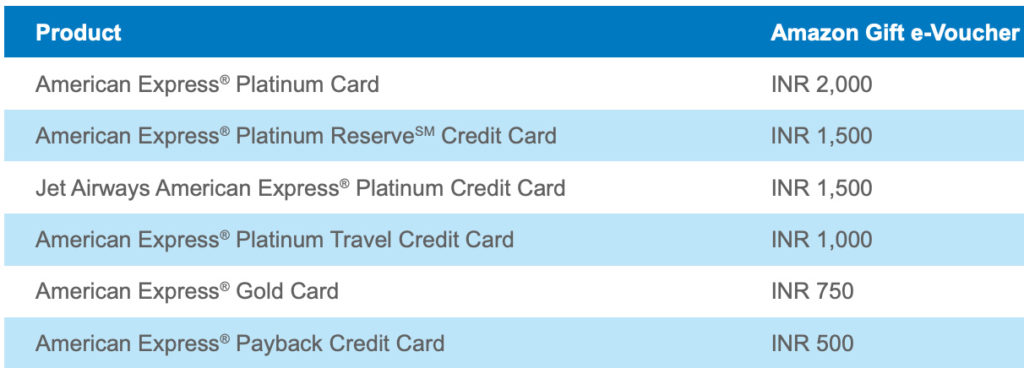

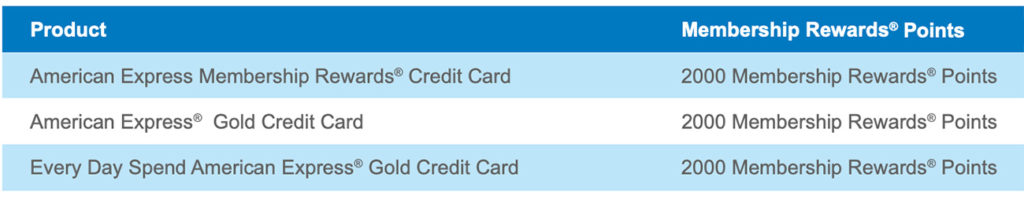

Now they’ve come-up with yet another exiting offer with a mix of Amazon Vouchers & Amex MR points based on the card you hold. Here’s all you need to know,

Amex Supplementary Card – Offer Details

- Offer: Refer above image

- Offer Period: Apply between December 20, 2018 – June 30, 2019 (Extended)

- Fulfilment: On or before Sep 30, 2019.

- Source

That aside, you may also need to know how many complimentary Supplementary cards are eligible for each of the card. Here are the numbers,

- Amex Platinum / Amex Plat Reserve: 4 Supp. Cards

- Amex Plat Travel / Amex Jet: 2 Supp. Cards

- Amex MRCC / Amex Gold Charge: 2 Supp. Cards

As you can see, apart from the expensive metal card, Plat Reserve is the sweet spot to grab Rs.6,000 worth of Amazon Vouchers. Offer on Jet card too is good enough.

The best way to maximize the offer is by getting the Free Amex MRCC or Free Amex Plat Travel card and get supplementary cards on that.

Note: If you’re planning to get fresh credit card to avail this offer, consider applying from above links as you also get additional 2000-4000 Bonus MR Points (check link for more info) on card approval.

Bottomline

Amex offers are one of the lucrative ones in the industry and these supplementary card offers are by far the most rewarding ones at the moment.

Note that Amex also frequently sends offers for the spends on Supplementary cards. So its totally worth going for it.

What’s your take on the current Amex Supp. Card offer – Hit or miss? Feel free to share your thoughts in the comments below.

Offers are great. Want to add amex on my card list. I’ll be applying late next year.

Building my credit line

Increase in ITR for 2019.

I’ll make sure they don’t deny my application again.

If there is any suggestion/ tricks.

Please let me know.

You already know it all. As we spoke in detail on this, you just need a short cooling period on new cards. Everything should be okay post that 🙂

Hi Siddharth,

I am contemplating a third Amex Card, if I will be permitted to apply. Already have the Plat Travel, Amex Jet and planning for the Reserve Card but guess somewhere I had read the application would get rejected as one cannot have 3 cards. I am not sure if that still holds. Will the above link get me 15,000+2000 additional points?

Its usually 2 Credit Card + 1 Charge Card. This wasn’t strict until recently (Nov 2018) and the sales guy said that the new applications beyond this limit shows an error these days. Not sure if its same across India. You may need to check with your local Sales team before attempting. Exceptions can be taken for Plat metal card though!

Its 11k+4K MR Points for Reserve

What I have been told about the limit of Amex cards is this: 1 charge, 1 co-branded credit card (like the Jet Plat or the MMT one), and one non-cobranded credit card. Now I do know a few folks who have had an exception, and most of the times the additional card that was causing the exception was something that was offered by Amex, and not proactively sought by the card holder.

This still isn’t strict and has never been. If Amex tells one that, that’s a polite way of saying that based on one’s profile, they can’t offer more. If you spend high enough, Amex thinks you’re cool enough, or if you’re tagged as HVCM or have a corporate relationship, Amex will get any number of cards, even multiple copies of the same card.

The only exception I know of is that enrolment into Centurion program cancels your Personal Platinum, and enrolment in Platinum cancels your Gold. This is odd, only happens in India and I’m sure will go away soon, given how quickly Amex India is coming up to speed lately.

Hey Obi-Wan aka Amex Guy ~ what’s HVCM? 😀

“Amex thinks you’re cool enough” – Need to up my “Swag” on the double!

It means a High-Value Customer.

That combination is permissible. Three cards are allowed, provided *exactly* one is co-branded.

What’s the difference between Gold credit card and Everyday Spend Gold credit card? I thought they were the same product.

They look same but are different in benefits wise. They were supposed to get its actual design as in US but maybe its not getting good traction for that to happen.

The Everyday Gold Card gets proper FTO MR account, the same as Reserve, Plat. Your points never expire and can be transferred to all partners.

The Gold credit card comes with non-FTO MR account, and upgrade you FTO is possible on payment of an extra fee. Otherwise, MR points will expire within 3 years and transfer to some transfer partners will be restricted.

FTO = Frequent Traveller Option, if you didn’t know.

Do most amex connect offers also apply to supp. cards?

@Siddharth

I already have HDFC Regalia and SBI Prime. Does it make sense for additional Amex Plat Reserve card? Already have Taj,Trident and priority pass from other 2 cards. Amex PR is quite expensive to maintain as they do not have spend based waiver program. Should I go for it?

Holds good atleast for the first year with this offer!

Well, applied via your link (though more regular reader of LFAL but heard this offer here first so).

And I do have jet plat though planning to discontinue same once supplementary card bonus recieved as I don’t find value in it, especially as most amex offers exclude that and Jet situation is dicey as it is.

Going to discontinue all cobrandrd jet cards- amex, ICICI- and going for others.

For Amex, it’s plat reserve for 1 year, will see later on others.

For ICICI, went ahead with signature mmt. Like it’s ola and kinda lifetimefree with that joining fee and bonus.

Thanks for using the link 🙏

Applied through the link. Lets see how many points they give. Thanks

Got my card today. Thanks. Not sure how will get the extra RPs.

2k point On spending Rs. 5,000 in the first 90 days of Cardmembership. Pls check the link for detailed info.

Applied through link and got the card today.

Any idea on value of the points?

P.S- any plans on top debit cards in India article?

Are these vouchers awarded only when applying through online mode?

Supplementary Cards sourced through all the channels will be eligible for this offer.

Want to apply Plat Travel through your link but in a dilemma whether Supplementary card offer is valid till today (31st jan, 19) or till 31st March 19. Read somewhere that supplementary card offer is valid till 31 match. Can you confirm the same?

Yes, you’re right. They’ve extended it till 31st March 2019. Pls refer the source link in article for updated dates.

New jet cards and not being sourced now. Further For Plat Reserve they have become very particular about 10 Lac + income that too on Salary Slip rather than F 16.

So, plat reserve is out of question even if the total salary Is even a whisker less than 10.

How do I apply for supplmentary cards? The link provided is for a fresh application.

Login to your account -> Account Management. -> Card Management -> Apply for supplementary Card.

Or

Call Amex. They are nice and helpful.

Are spends clubbed for primary and supplementary cards for determining spend threshold ?

For instance platinum travel credit card gives travel voucher on reaching four lakhs spend in a year. So for this purpose are spends from both primary and supplementary card clubbed or are they considered seperately ?

Hello,

I’m a bit confused as to why would they pay back for a supplementary card? Do the supplementary cards have some costs added to it, even for the Free cards? I mean I want to understand the catch here. What I just apply for the supplementary card and store it in a corner and never use it? What charges, if any, will be applicable for me?

Thanks

Amex is a business oriented brand,they just want to earn good amount of money from any business, AMEX is single issuer and processer too,so they earn good enough if you transact through amex alot as they charge around 4%,so more you transact and more chances of EMI conversation as transaction is more,so they provide supplementary card,so they get good transaction and bussiness and also reward for getting supplementary card!🙂

@Prabhdeep – Absolutely no charges

There are no charges for supplementary cards. Many banks gives benefits on applying supplementary cards. Bank knows that you will apply supplementary cards for your family members and they will use it to increase spend on the card account. Thats the whole purpose.

SCB Ultimate also giving Rs. 500/- Amazon voucher on 1st swipe of Supplementary Card.

I have few queries related to this :

1. Is supplementary card and add on card is same ?

2. I have MRCC (eligible for 2 supplementary card as given above) so will supplementary cards fees will be charged extra or these will be free ?

3. Limit of my existing card will be shared between supplementary and primary card?

4. I have MRCC, can I apply for Platinum Travel Card also as a supplementary card or I can only apply for MRCC as supplementary or add on card?

1. Yes

2.NO

3.Yes

4.No, you can apply for a separate Platinum Travel card. For MRCC you get MRCC supplementary card.