Below article maybe outdated, kindly check the Millennia credit card review for latest info.

India’s largest credit card issuer, HDFC Bank today has launched series of cards: Credit/Debit/ Prepaid/EasyEMI cards in partnership with MasterCard, targeting the millennials of India, the segment that account for 34% of India’s population. Here’s a look into all of them:

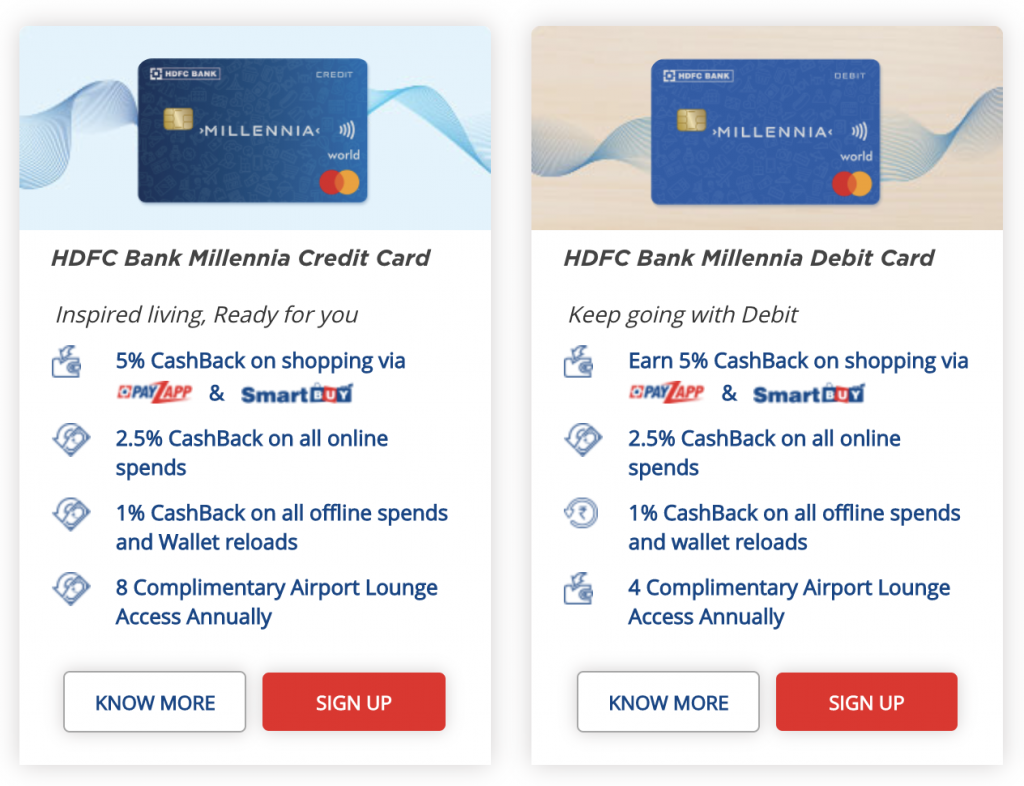

These are basically the cards for beginners with similar benefits across all card types (Credit/Debit/Prepaid/EasyEMI) and are tuned towards the lifestyle of Millennials. A quick look at the features of credit & debit cards are here:

For more details, visit the bank site here

Millennia Credit Card – Overview:

Let’s look at credit card benefits/features alone for now,

- Fee: Rs.1000+GST (waived off if you spend ₹30,000 and above in the first 90 days)

- Renewal membership fee will be waived off if you spend ₹1,00,000 and above in the first year

- Launch offer of ₹1000 worth gift vouchers on spends of ₹1,00,000 and above in each calendar quarter for first year only.

- 5% CashBack on Amazon, Flipkart, Flight & Hotel bookings on shopping via PayZapp and SmartBuy (minimum transaction size of ₹2000)

- 2.5% CashBack on all online spends (minimum transaction size of ₹2000)

- 1% CashBack on all offline spends and Wallet reloads (Minimum transaction size of ₹100)

- 8 Complimentary Domestic Airport Lounge access annually

- 1% Fuel surcharge waiver

Worth it?

With good minimalistic design & 2.5% cashback on Online Spends (txn: >2k INR) that simply replaces most other cashback cards in the industry.

But hey, the upper cap is “Rs.750 per month” for this category. That’s about Rs.30k monthly spend which is bit low but still good for most “regular” credit card users.

So it all looks good for now, we will know how this actually works in reality soon.

Bottomline

That’s a decent value proposition for this segment except that the small upper caps disappoints a bit. If you’re holding HDFC Bank’s super premium cards like Infinia or Diners Black, this may not interest you.

But for those who’re holding Regalia First or other lower end cards and need better returns on online spend, this would serve as a good upgrade.

Remember, this cannot actually be directly compared with Regalia range of cards, as Millennia cards don’t have international lounge access benefit. But if you’ve multiple other bank cards which gives you Intl lounge access benefit and unable to upgrade to HDFC super premium cards, this would be a perfect fit.

What’s your take on HDFC Millennia Credit Card? Feel free to share your thoughts in the comments below.

Hi Sid I am interested in debit card if it gives 2.5% cashback on spends on Cred . What do you think will cred spends qualify.

It may disappoint you then.

This is a very interesting idea! First get cashback on the credit card, and then get cashback on paying off the credit card!

The caps are 750/ per category ! That’s Rs 2250/ per month ! Whopping !

How to apply for these cards?? Do we have to be a customer of the bank necessarily?

Hi Sid, which one is better hdfc millinea debit card or platinum

icici coral gives, i keep getting paybackpoints for spending on cred app. avg spend on the app is ~50k a month to a lakh, i easily get around 1000rs worth payback points

HI Veenus,

How to get payback points on CRED ?

Can you please explain ?

i was eligible for hdfc debit emi 3 months back.i have purchased galaxy watch for 20k from amaon.but unfortunately i had returned it due to the size issue…the return was complete.i have paid the penalty to the bank and everything ontime..i have checked with my branch also..the issue is after this order iam never eligible for hdfc debit emi…what do with this…? hdfc never mentioned u will lose the eligibility if u return the product..

Hey Sid

Can we upgrade with moneyback credit card?

Should be. We will know all soon.

HDFC finally changing its stance again on wallet reloads… nice to know that

This card is targeted for masses. If you want to feel premium & get attention from customer care, then better wait to see how market responds to this. This card is brought to heat up the middle segment & gain the lost ground against APICICI or recently launched co-branded credit cards with E-commerce players

Yes, what you told is absolutely right. I was expecting a card from HDFC Bank like this, because Amazon Pay ICICI Card and Flipkart Axis card gives good cash back and rewards. To confront these cards in current market, hdfc bank much needed this move.

Hi Sid,

It is 750 cash points. I believe..

maximum CashBack of ₹750 per month

CashBack will be given in the form of CashPoints,

1 CashPoint = ₹0.30.

please add full detail

1 CashPoint = ₹1. (for stmt credit)

1 CashPoint = ₹0.30 (for flight/hotel redemption)

This conversion is reverse compared to other cards!

Detailed review maybe after few weeks.

I think someone in their product team goofed up while writing the details and this will be reversed soon.

lol. I doubt. As they market it as a cashback card, similar to others in competition, they might have decided to give better value for stmt. credit.

These cards will make sense to 80% of the users in India. Amazing product. The only apprehension is a downgrade at a later stage. Fingers Crossed.

Either this or HDFC will add a condition that will credit cashback after 90 days. Those 90 days will be the longest 90 days in human life

HDFC is out to become the primary card for spends with this and they have made the redemption tight to make ppl stick :

The minimum CashPoint balance required for redemption against the statement balance is 2500 CashPoints, redeemable in multiples of ₹500 only.

Unredeemed CashPoints will expire/lapse within 1 year of accumulation

If this is the case and someone forgets or does not spend enough, the points will keep lapsing and will give zero return. High restriction of 2500 points.

Better to take ecommerce partner cards and keep other card of HDFC instead of these.

Hi Sid,

It was reversed when I read it from what it is there now. Does not make sense DCB and all, it is reverse..

Thanks

Ankit

cash back is 1re- per point, ive applied> check option for auto upgrade.

The lounge access is mentioned to be across MasterCard/Visa/Diners which means that the card is available with all options.

Yes, noticed. Could be Mastercard is primary.

I have received option for upgrade for my money back to regalia first. Should I opt for the upgrade or wait for the launch of millenia credit card?

Go for Regalia First, it’s a great card still, lots of features

I would still prefer cards to include the option of points to be converted to statement credit. This is missing in both Regalia First and Regalia cards. Sometimes all we need is the money!

Looks like now you’ve an option 🙂

They have made it complicated for Millennia, very unlike AP ICICI or Flipkart Axis CC. If you are holding any of these, I think Millennia doesn’t make much sense.

In order to redeem those points for Statement credit, a minimum of 2500 points are reqd, meaning Rs. 50000 per year on 5% category and this min spend increases for spends on other categories; min tx of 2000 for additional points online adds to the woes.

Too many conditions to remember and higher annual fee than Amazon or flipkart cards. Need simpler cards to make a mark.

Hahahaha..

That’s how HDFC does want it to be.. so that more and more people goof up.. n keep calling them for issues..

Just like 9x reward accrual on other premium cards..

Exactly.

Wondering if they would give 2.5% back on online insurance premium payment transactions or would keep it in the 1% back category ?

Well looks like HDFC is quite serious about doubling it’s customer base from 12 to 25 million.

Regalia First would still be a better card if you are a frequent traveler – you get free international lounge access + the Forex mark-up is only 2% which is even better than premium cards like SBI Prime

This would be of interest regarding this card –

HDFC is targeting 2 million users for this segment

HDFC already own

50%of credit cards circulated in IndiaThey will remain pioneer forever

Millenia or as it says in Hindi “Milley Nahi ha” i.e. those who haven’t met yet

So those who haven’t yet got HDFC card, this could be good beginning

The credit card isn’t quite appealing IMO. I would much rather go for the debit card. Although the fee of 500 is on the higher side, I feel it could be recovered thru cashbacks and Lounge Access.

How much is fcy markup fees? 3.5% or 2%?

If it is 2%, I’ll opt for this instead of regalia first. Else, I’ll wait for hdfc to upgrade it to regalia.

Definitely not 2%, so 3.5%

And there is no International lounge access if that matters to you

Hello Siddharth,

Do you think that this card is better than Club miles diner card ? Cashback seems to be better than diners rewards & premium cards as well.

There are way too many conditions to utilize this card. Take club miles and for cashbacks take ICICI Amazon card or Flipkart axis card.

@Ankur

You are correct . Good advice Ankur ! I agree

This is too good to be true. I am pretty sure, this is some goof up.

Hello Sid,

I’ve option between clubmiles, millinea and regalia first in pre-approved.

My itr is low so i don’t know if this pre-approval on their online portal means anything, never applied for any cc in hdfc but have a classic saving a/c with them.

I was thinking to get a diners cars as I’ve some visa/master premium ones from other banks, so is this is a good choice? Can you tell which one is nice? Domestic use primarily.

I meant clubmiles diner, as online i couldn’t find option for millinia diner and they may randomly assign visa/master if i go ahead.

They told me I had pre approval for regalia first..I don’t have any credit cards with HDFC except savings account with good AMB.

Pre approved means ,will they check CIBIL..?

Yes. For preapproved card, HDFC will do a cibil query to check if their is no negative report on your cibil. But HDFC will approve your card if you have good relationship with them.

@Sarkar @Kishore : Both of you will get HDFC credit card without any documentation if it is pre-approved, My CIBIL was -1 and still i was pre approved for Diners Black as my First credit card one year back and that too with 8 Lakhs credit limit which has now been increased to 9.5 Lakhs.

So, With HDFC Pre-Approved which works on Banking relationship and algorithms, there is no need of CIBIL or ITR.

Wow

Hi what about Millennia debit card? Anyone received the option to apply through NetBanking? I don’t see this card in card upgrade option.

Tell me if anyone got this card….

Got this card couple of days ago… through branch,

Now they provided the upgrade option through net banking…

I am having a preferred relationship with HDFC. I am getting an option in netbanking for preapproved credit card viz., Millennia, EasyEMI, Regalia First and Diners Clubmiles. Can anyone tell me the procedure if I opt to apply for pre-approved credit card through HDFC netbanking? I.e., whether there will be any verification at residential or office address, document collection, salary slip /ITR requirement etc., if I decide to apply? I am thinking of going for Diners Clubmiles so that later I may upgrade to Diners Club Black.

ICICI Amazon Pay card is the best in the market so far in terms of cashback. No riddles involved in terms and conditions + LTF! Considering these reward to cash ratio etc, ICICI amazon pay card scores ahead of every credit card!

@Narayanan

What about Flipkart Axis card instead of Amazon pay Card. Is it better? What do you say?

Flipkart Axis CC also has conditions such as rounding up spends for cashback (CB) – 1 rupee for 123rs or 3 rs for 360rs – and for 4% on partners, you need to use coupon codes, meaning you can not use any other coupon codes on MMT for example (might be helpful for Urbanclap or Uber who does not give many coupons)

ICICI AP is a no-frills card – no restrictions as mentioned – just like how Amazon is in general – clear, simple, and easy T&Cs

Looks like SCB had launched a competitor for this card. The DigiSmart credit card.

I tried to apply for the millennia credit card but the executive at the credit card department in my home branch said that a person can only hold one HDFC credit card at a point of time. Is there such a limit for number of HDFC credit cards per person ?

Converted my now useless JetPrivilige Debit card to Millennia Debit Card. Hope it keeps the promise 🙂

How you converted, through net banking..?

Hi Prasenjit,

How did you convert the debit card? I have checked online now too and there is no option to convert yet. If you have applied through branch, could you tell me the debit card code to fill in form?

Is the annual fee waived for classic, preferred customers?

Hi Sharath,

I applied through my RM. You can’t choose it online as of now. Didn’t ask for fee wavier. But was able to get it waived for Jet Privilege card in the past. So hopefully will be able to for this as well.

Hi Prasenjit

Are you able to add money to patym and able to do transaction on cred using Millennia Debit Card.

I’m asking you because mine is not working the debit card is being identified as a prepaid card.

If anyone else also has got the Millennia Debit Card please tell your experience regarding the same.

For me I’m also not able to add the card to Samsung Pay.

Hmm … that’s interesting… Didn’t try it yet. Will let you know once I try..

It’ll be interesting if they offer cashback on Cred payments.

@karan

Yes..I have added to the paytm wallet and Paytm bank also(upto 2000 with debit card)..but mobikwik not accepting this debit card for some transactions, it’s showing “credit cards not allowed to do this transmission”

Just wanted to make sure this is correct,

1) The card fee is Rs.1000, but on Spending Rs.1,00,000 fee will be waived and if not, then we will still get “Welcome Benefit/Renewal Benefit of 1000 Cash Points” which is worth Rs.1000?

2) The maximum Cashback of Rs 750 per month is per category, meaning 3 categories so max total cashback Rs.2250 theoretically is possible

3) Transactions via PayZapp and SmartBuy and all online spends less than 2000 would earn 1% or not earn any points? can someone confirm this.

4) Points expire in 1 year and minimum required are 2500 and a fee of Rs.99 applies?

5) Gst would apply incase on waiver of fee or not

Thanks

even i have these doubts, you got answer for this

Is that prepaid card is considered as a credit card or debit card? Can I use is to make Cred payments?

I have a Question. Which one should I get? (Annual Fee is not a issue..I’m looking for a card with maximum Benefits)

I currently have JetPrivilege VISA Signature Debit Card and its of no use to me now…

Millennia Debit Card, Platinum Debit Card or Times Point Debit Card?

Go for Millenia as it gives cashback on various spends as well as 1 lounge access quarterly. I also switched from Jetprivilege to Millenia.

Millennia Debit Card is now available through netbanking! 😀

But with Cred benefit gone, feels sad :/

@Rajesh

Is it free for classic banking program customers ?

Haven’t been sent any notification.

It was free for my SavingsMax account, so should be free for Classic too.

request to upgrade to Millenia Debit Card is available through net banking

Yes. I applied for it on 26th September 2019 and got it on 29th September 2019. The card number is mentioned on the back of the card which makes it more appealing.

Can anyone using the Millennia Credit card confirm whether any Cash points/rewards points have been credited back to your accounts/statement? I have been using the Millennia card from the last month with cumulative spends of more than 31k. However, yet to receive a single Cash point/reward points against my card. Please advise if possible.Thanks.

From HDFC Millenia Product page “CashBack Points will be credited in 90 days from the date of transaction”

I think you will get it once the bill is paid. Did you get any as it’s been long time?

After multiple followup via email ,cash points have been credited with this mknth’s statement.

to which mail id you followed up , same thing happened to me also and nit gettting poins as promised also some points as reducing andcomes under colom redeemed/ adjusted/lapsed. didnt redeemed till now. my spend for last three months is around 1.25 lac and point credited is 305 only

yes, hdfc is thief, they do not give reward points on time ,i think they credit reward points in 90 days . I also did not get the rewrds as promised. Do not know why? Its better to use axis flipkart card and icici amazon pay card. HDFC cards are worst. I never recommend the HDFC cards.

HDFC is known for bait and switch tactics. They will attract a mass of volume with this card and then devalue it. Same thing happened with their money back card. They had 1.6% cash back on all online spends and then they devalued it to .8% simply by reducing the earning rate and the point value. Same will happen to this card. I was stuck with one such money back card for years.

I have a question…which one to get?

HDFC Millennia Debit Card v/s Millennia Credit Card OR any other Credit Card from HDFC?

Mainly spending is online, Utility Bills + Fuel.

Unless you’re a frequent flyer and stuff, Millennia should be the best option from HDFC for online spends I’d say, provided you can make the T&C work.

Hi I am being offered a diners variant of millennia card , is there any added diners benefits on this or just like other variants Visa/ Mastercard . Hope someone could put light on this variant , as it’s not present in there diners website .

Thankyou

Yes, you get additional headache for free (Diners=low acceptance, HDFC=Will give RPs at my own will)

for me too HDFC has offered an upgrade from Diners Premium to Diners Millenia. My Diners Premium is LTF card. The upgraded Millenia is having an annual fee. Is it worth going for an upgrade mainly for redeeming the rewards points as Statement credit?

Does the 2.5% reward rate apply for online insurance premium payment using millenia credit card ? Can anybody please confirm.

Does the 2.5% apply for redgiraffe payments?

What is this fuss about HDFC sending emails to target customers for Diners variant of Millenia card? It’s not on their website!

Guys ! Just 3 days ago i had enabled a bill payment option through BILLPAY on HDFC netbanking for utility bill payment through my Millennia DEBIT card. But, today i had an Unauthorized/Fraud International transaction on my debit card. Luckily, my International was disabled and the transaction didnt go through. I have blocked the debit card immediately and also disble and deleted utility bill from Billpay in netbanking. Just curious ! Was there a leak from Billpay Billdesk ? Beware ! Disable your International transactions on Debit & Credit card when not required.

Hi Sid, Its been a year and you have reviewed Millennia Credit Card yet.

Any reason for not covering this card and Any future plans regarding the same?

Will cover in detail in a month.

Eagerly Waiting for your Review of this card.

Thanks in advance.

PS: Please share additional tips and tricks to maximise the gains from this card.

Didn’t find time. But coming soon, this month.

Does Millennia Credit card fall under the category of premium card? I already hold Regalia First but on net banking it says that Millennia is an upgrade from Regalia First. Does this mean Millennia is better than Regalia First?

Rs.750/- month capping but I doubt when they consider the month? Like 01-30 September 2020 or statment credit card date 05-05 of the month??

Hi, I have HDFC EasyEMI (add on) card along with DCB (primary). Did anyone load DhaniPay prepaid card using EasyEMI card? Did it give 2.5% (online txn) or 1% (wallet load) CB?

Dear Siddharth, looking forward to your review of this card.

I have been using it since January. Think HDFC seems to have really messed up on the reward point front. They first added and then debited some points from my account saying the points were erroneously credited. That made me check my statements in detail, and then I realized they were not crediting any reward points for Nobroker RentPay transactions through Payzapp though both Nobroker and Payzapp continuously notify customers about 10 % benefit if you use Millennia, 500 Payzapp cashback available to all, and up to 750 reward points on the card.

I have since been involved in a prolonged email battle with the HDFC customercare. They initially gave me a reward point structure that was entirely contrary to what is mentioned on the Millennia page. When I posted the link and screenshots of the Payzapp/Nobroker notifications, there hasn’t been any meaningful response.

Forget 5 percent and 2000 transaction minimum, they don’t give any rewards for transactions even above 20000. And using the Covid situation, the customercare would never take calls on these issues, and they don’t ever address your question on email.

So, the way points are calculated is not at all non-transparent

Coming soon. Thanks for sharing your experience.

I believe they’re debiting it because of the rent/utility nature of no-broker payments. Did this happen for other type of txns too?

It happened with me once where there were no reward points for paying rent through DCB using payzapp. Customer care mentioned about the paytm gateway. Since then i am using my ultimate card through payzapp. Getting Rs 500 for payzapp and 3.3% points on ultimate

What’s ultimate card, and the Paytm gateway. Could you please elaborate.

How can I upgrade hdfc moneyback credit card to hdfc Millennia credit card? I haven’t received any card upgrade offer yet from beginning. It has been 2 years since I got this card.

Please reply this query as soon as possible.

Ask HDFC care for upgrade related query.

Update the article by removing 2.5% category for Credit Card