Following the recent trend in the industry, the ICICI Bank has come up with a brand new shopping portal in the name of iShop, a shopping/travel booking portal that offers accelerated rewards on spends, similar to HDFC Bank’s SmartBuy.

ICICI Bank’s iShop portal offers up-to 12X rewards on spends done on the portal that gives a reward rate of up-to sweet 36%. Here’s everything you need to know:

Table of Contents

Accelerated Rewards

| Credit Card | Regular Rewards | iShop Flights / Vouchers (6X) | iShop Hotels (12X) |

|---|---|---|---|

| Emeralde Private Metal | 3% | 18% | 36% |

| Times Black | 2% | 12% | 24% |

| Emeralde PVC | 1% | 6% | 12% |

| Other Cards | 0.75% | 3% | 6% |

| Co-brand Cards (Cashback) | ~ | 4% | 4% |

Apart from that, even debit cards and NetBanking transactions would earn accelerated rewards, but they’re not exciting per se, so it’s safe to ignore.

That’s outstanding 36% return on hotels and upto 18% savings even on vouchers, especially on Amazon Pay Vouchers too. We’ll look back after a week or two to see if it continues to exist. 😉

- Update: As expected, capping has been introduced for accelerated rewards in ~2 weeks of launch, on Flipkart, Amazon Pay & Amazon Shopping Vouchers. Limit: maximum of 12,000 INR per month.

Max Cap

| Card | Max. Cap (on Bonus) |

|---|---|

| Emeralde Private Metal | 18,000 Points |

| Times Black | 15,000 Points |

| Emeralde PVC | 12,000 Points |

| Other Cards (Coral, CSK, HPCL, ManU, Parakram, Rubyx, Sapphiro) | 9,000 Points |

| Co-Branded Cards (Amazon, Adani, Emirates, MMT, etc.) | ₹1,100 Cashback |

It’s evident from above that ICICI Emeralde Private Metal and ICICI Times Black Credit Cards are the best ones to hold to take advantage of the iShop accelerated rewards system, as both reward rate and max cap are good enough to explore those cards.

That’s about 1L INR spend equivalent on Emeralde Private Metal or Times Black for Flights/Vouchers or 50K INR spend on Hotels, which is quite good.

That said, I’m not sure if the cap is on calendar month or statement cycle.

Redemption

- Flights: 95% points (1 Point = 1 INR)

- Hotels: 90% points (1 Point = 1 INR)

- eVouchers: 50% points (1 Point = 0.60 INR)

So there are 2 portals now if you wish to redeem rewards earned on ICICI Bank Credit Cards.

One, the regular rewards portal which ICICI Bank recently launched by replacing Payback points system. The other is the new iShop portal.

One can redeem their existing rewards on their ICICI Bank credit cards for anything on iShop portal, partially or fully, with above restriction in place.

The ICICI Bank’s iShop portal is much better compared to HDFC (Smartbuy), Axis (Traveledge) or most other platforms for typical travel redemption.

The portal looks neat and simple and lists all cards linked to your profile beautifully, along with the points available on each.

However, it is to be noted that ICICI is yet to bring up their points transfer partners into the system, which I’m hoping would go live anytime.

As of now, one can transfer points to Air India at 1:1 on regular rewards portal.

Is it Live?

I contacted ICICI Wealth Banking support regarding this, but they lacked clarity and simply advised me to trust the information as long as its on the bank’s portal.

I also reached out to ICICI Bank’s PR team, who confirmed that there has been no formal launch of iShop so far.

At this point, there is no official communication. However, even Axis Bank never explicitly communicated about the Travel Edge portal for a long time after its launch.

So it seems this is targeted at maximizers – allowing the bank to generate some good revenue while points maximizers get what they want – rewards, lots of rewards!

iShop Portal

- Open the link: icicibank.com/ishoplogin

- Login using your ICICI Bank credentials and it will take you to the iShop portal.

- Choose the category from the menu

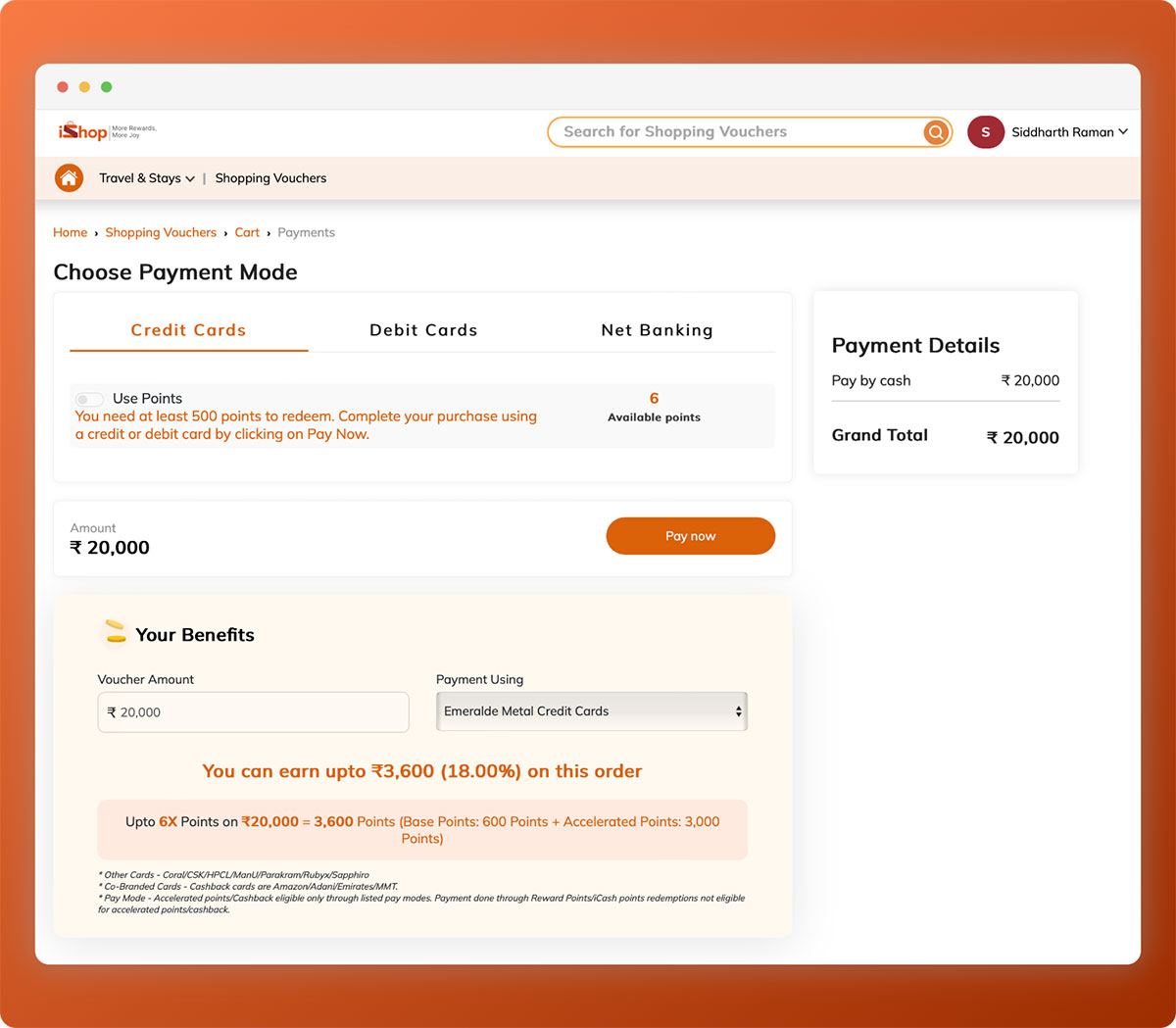

- Verify the bonus points for your card before placing the order & proceed with payment.

Hands-on experience

I attempted to buy eVouchers using my Emeralde Private metal, but the transaction was initially declined for “security reasons”.

Since I’ve faced similar issues before, I knew the fix – calling support to whitelist the merchant/transaction on my account.

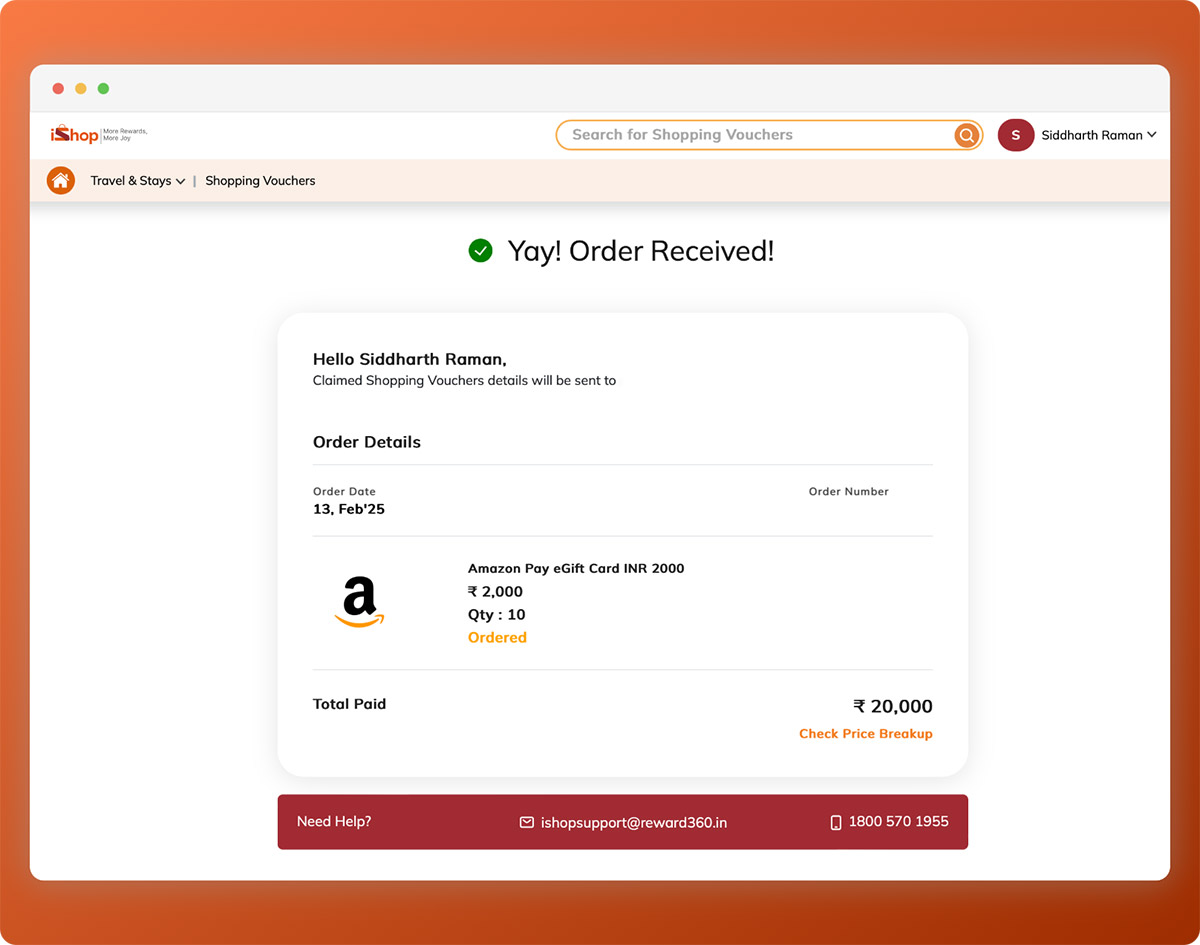

I tried again after five minutes, and this time the transaction was successful. The vouchers are working without any issues.

That aside, I did notice that the system is picking the rewards on my ICICI Sapphiro credit card (replaced from Intermiles Sapphiro) but not the rewards on Emeralde Private metal’s.

That looks weird, so I’ve dropped an email to support to see if they can fix, or I’ll better close the Sapphiro to see if that fixes the issue.

Now, it’s a waiting game to see if the rewards kick in as expected – and how will it be given? as regular rewards or as iCash!

In a nutshell

ICICI Bank Credit Cards were never considered as a mainstream credit card for reward seekers, because of their not so good reward rate.

But with the launch of the accelerated rewards on iShop portal, their super premium credit cards like ICICI Emeralde Private Metal & ICICI Times Black looks lucrative all of a sudden and now it competes wonderfully well with Axis and HDFC Bank in the segment.

Given that ICICI Emeralde Private Metal is not easy to get, I’m expecting lot of applications going towards ICICI Times Black Credit Card, which makes sense for those who can’t get hands on with Axis Magnus Burgundy or HDFC Infinia.

While the initial impressions of iShop are promising, time will tell if it reshapes the perception of rewards on ICICI Bank Credit Cards – until then enjoy more rewards & more joy with iShop.

Hi Sid,

As usual great article. I guess now ICICI cards are good rewarding at least in segments offered in iShop. btw, how much time it took to deliver the amazon gift cards.

It was delivered instantly.

Hi Sid

On my Emeralde metal i am getting 95% for flights and for vouchers only 0.6inr value

for hotels and flights point equals 1rs but not for vouchers

this is on ishop portal

I couldn’t check this because my points aren’t reflecting as expected. Will check shortly and update accordingly. Thanks for informing.

Update: Now ICICI allowing to choose the card for points bucket, so I was able to check, numbers updated.

Can you please explain more on points bucket ? Or where to check points yet to be credited ?

What do you mean by 95% value? Also if you redeem points on vouchers other than lux gift card and hotels/OTAs then the value was always .6.

95% is points redemption restriction, rest 5 needs to be paid through cc

Re value: i thought with the ishop portal it has been revised to 1rs but seems it’s the same as 0.6/point

Hi Sid,

I have ICICI Sapphiro credit card with 7L limit.

But I rarely use it coz HDFC infinia.

How to upgrade to Emeralde Private Metal.

Please guide.

The bank has tightened the rules a bit lately. When I checked few months ago for someone, RM said that they’re now only processing the request for pre-approved list which the branch gets from time to time.

But if there is significant relationship with the Bank, it should still be possible to grab an upgrade.

Any idea on reward rate for emeralde emirates co branded card.

Excellent move. I hope they will come up with airline and hotel partners too

Crazy timing, Sid! I just (~fully) loaded my Amazon pay wallet. Thank you.

Hi Sid, when will rewards points credit? I buy Amazon vouchers using emeralde plastic card. But I got normal reward points only.

I got just the base rewards too. Not sure when the incremental points are supposed to be credited. The T&C and FAQs don’t mention any SLA. Will have to call them and enquire.

This is a strategy to get more customers cards and later after 1 year remove everything. I was the only person in my circle who did not take Axis magnus and after 1 year all cancelled it 😃😃

I think you missed out by not taking. One year was enough to earn a truck load of free stays

Make the hay while the sun shines

Hello,

I have an Infinia card and SBI cashback. I was looking to have a second premium card. Would you recommend this ICICI Metal Emeralde or Amex Platinum Travel?

If you can get Emeralde metal, it will be best.

My experience says that Amex cards and points are completely useless. They are all hype by paid social media and blind brand followers . I have Amex Platinum Charge card which I will not be renewing. I have 23k points which are useless.

You can try for Emeralde Metal, or even Axis Atlas is good. Or even try to get HDFC Biz Black if you are business man.

Amex is a big NO. Axis Magnus (Burgandy if you can get) is better than Amex.

Hello,

Thanks, Sid, for the great article, as always.

Anyone know –

1) the eligibility to apply for new EPM card, considering the only association is CC with ICICI.

2) Black Times card seems to be available to apply, will it help in future to upgrade to EPM?

TYIA.

Regards, GG

I requested upgrade via email. I was requested to visit nearest branch of ICICI bank for the same. There I came to know that 3 factors are needed for Emeralde Private Metal as of Feb2025. 1. Minimum credit limit of ₹5Lakhs. 2. Minimum internal revenue to ICICI from your relationship for ₹40,000/ month. 3. Minimum ITR of ₹24L/annum for salaried.

These factors qualify you automatically.

If any of these needs to be waived, then recommendation of the Branch Head may help.

Thank you, Mahadev, for the insights. They are helpful. I have 2 CCs from ICICI (A’pay and platinum), no other relationship.

For meeting criteria for “internal revenue” – is it monthly spend on CC or MAB for saving account? I think I meet other 2 criteria.

I assume visiting a branch is a must.

Thanks again!

Hi Siddharth, nice article. Have few query

On Ishop Is it possible to buy 10 amazon pay vouchers of INR 10000 each in a month ? Is there any monthly limit ? Any convenience fees ?

For redemption, is it possible to have 1:1 for tanishq vouchers ? Any redemption limit ?

Any clue when we will get the additional points.

I make a transaction using emrald private card. I can see 3 percent points in the mobile app against the transaction.

We does the other 6x gets credited ?

From iShop Support: Typically, your ICICI Reward Points/Cashbacks are credited to your ICICI Bank Credit Card/Debit Card within 90 days of the transaction or from 45 days of the completion of travel, stay, or delivery of the voucher, whichever falls later.

Let’s hope it happens early in reality.

Nice post . Now I have to see which icici card can I apply?

Hi Siddharth,

Wondering what makes sense now between the (HDFC Smart Buy + Infinia) VS (iShop + Emeralde Metal Private)

Would love to know your thoughts

Don’t belive icici. They might reduce point value or impose restrictions on total value of the transaction. Hdfc is stabilized the process.

Hi,

Many of vouchers available on HDFC SMARTBUY are not available on ICICI iShop and vice versa.

For vouchers available on both portals, iShop is a winner with EPM.

Another most popular voucher i.e. Amazon Pay Voucher – On Infinia I’m getting just 12.53% return (recently HDFC started charging convenience fee of 3.5%+GST) whereas with EPM I’m getting 15.05% return (since on EPM ICICI charges only 2.5% +GST as convenience fee).

Difference of 2.5% on Amazon Pay Vouchers is huge.

Otherwise also, if I have the voucher both on SMARTBUY and iShop, I will be using iShop due to more reward points and also because I can redeem more points (90-95% in ICICI as against 70% in HDFC) for hotel/flight booking.

On sapphiro credit card, iShop is charging 99+GST for redemption of reward points. Is this the case with all credit cards and is this a flat fee?

Yeah. I did that as well

I bought new regalia forex card with 1000 usd and paid by dcb ? Will i get 5x on this. This 5x is on new card or only on reload ??

Nice article Sid, as neat as iShop new site 🙂

Made a transaction on Feb 20 at iShop for 19K…. Transaction is still not settled by icici. Customer care is clueless.

Looks like a popular issue faced by most. I also see one of my iShop txn still not showing up. Hope they don’t settle. 😉

Hi Sid,

I was also wondering why my transactions weren’t showing up on my statement which was 7 days after first transaction.

But now after 10 days, I can found it’s showing in current statement with only base rewards points credit.

iShop is still in beta, so teething issues may will be there.

Even my first transaction is yet to be settled, and the later transaction got settled with base points, hope rest of the points may come after few days.

Right now, things look too good to be true in some areas like no limit on Amazon Vouchers.

I feel they may put max limits in some area i.e. Amazon Voucher during release of iShop and Continue 6x (or so depending on card). Because I don’t see ICICI followed practice of degrading of cards as Axis did in these years.

If they limit total number of customers like HDFC Infinia do, they may continue with same reward structure with limit of vouchers per statement cycle if ICICI wants to compete with HDFC after all these years of non exciting cards by ICICI.

They have implemented a monthly cap of 12K Amazon pay vouchers. Quite a bummer and this is a show stopper for the card now. Regret taking this card. Will close next year.

is there any kind of capping on accelerated reward points for Emeralde Private Metal – monthly / daily?

It’s already mentioned in this article, refer “ Max Cap” section. It’s 18k for Emeralde Private Metal

Accelerated reward point is still not credited after more than a month (34 days). Base point is credited. Settlement of transaction happened almost after 25 days.

I checked with customer care they said accelerated reward point settlement TAT is 90 days.

Disappointed! Think Infinia settles it on or before statement date.

Sid,

There is some ishop helpline / customer care number. You can add that above.

Icici Ishop Call Centre, 1800 570 1955

Is there an expiry to the EPM points?

They havent even started crediting bonus points and you are asking about expiry 🙂

The regular points have been credited atleast. Just need to take care of whatever has been received 🙂

No they don’t expire

If we book hotel through IShop, will we get hotel brand loyalty points, or is it treated like 3p/aggregator and hence no loyalty points accrual on those stays wihichbare booked through iShop?

Hi,

First and foremost I am a big fan of this website. Like reading a story book I read this blog daily when I have freetime. My doubt is that I hold a Emerald Metal credit card with a add-on for my wife. The ishop portal shows each card separately. So will the cap of 18k is for both the cards combined or I get individual caps for each card i.e total of 36k points?

Is there any total limit on cumulative purchase or points through ishop

Do we get limit for each add on cards separately on Emerald Metal credit card or is it combined.

This link doesnt seem to be redirecting to ishop portal since yesterday. Is anyone else facing the issue?

Yes. It seems to not work since yesterday evening.

Yes, it was not working since yesterday. It’s working now.

I got to learn that there is some daily cap introduced on bonus rewards points. Is that correct? I can’t find anything on their website – but customer service mentioned to me.