SBICard recently has come up with a new Invite only super premium METAL credit card as predicted for High Net worth individuals and its called AURUM.

This was due for a long time and I used to think how come a credit card company goes for an IPO without even serving an important segment. But that’s all sorted now, and it exceeds the expectation, in a way.

The card goes officially live by today (3rd Feb 2021).

This metal card comes in black colour with Matte finish and a golden touch! SBICard has done a wonderful job in creating stage for their super premium product.

Here’s a quick look at the card benefits,

AURUM – Benefits Overview

- Annual Fee: Rs. 10,000+GST (renewal fee waived on 12L spend)

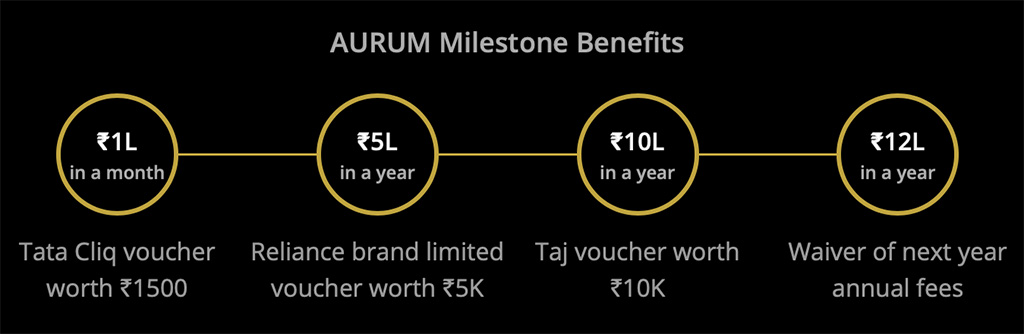

- Rewards: 1% (regular) upto 4.7% (via milestone benefits, movies, etc)

- Airport Benefits: unlimited (international), 4/qtr (domestic), 1 spa per qtr.

- Memberships: Complimentary Dining & Lifestyle memberships – Zomato Pro, Eazydiner Prime, Amazon Prime, Discovery Plus, Lenskart Gold, BBStar (6 months)

- Movie Benefits worth 1k/month

- Secretarial access & concierge

- Dedicated redemption portal

If you use all the benefits the card offers, you may get maximum of 4.7% reward rate, but that’s with lot of assumptions and there is more to it. Expect a detailed review shortly to decode that math.

How to get it? Its an Invite only card for now and the invites are already sent to few eligible customers by late Jan 2021. Do check your net-banking to see if you’re targeted.

I was eligible for an upgrade from SBI Prime, already upgraded and the card reflects on the portal within a day. I’m waiting for the delivery this week. If eligible for an upgrade, you would see something like this:

That aside, I did a quick call to AURUM support and to my surprise I was greeted with name, and I came to know that the card comes in a wonderful wooden box. It will also have a certificate of purity in the kit for the 22K gold used.

I should say that the executive was quite knowledgable to handle the super premium credit card customers.

I was said that the card is expected to be delivered by someone personally from SBICards team. That sounds amazing for now!

Final Thoughts

While the rewards are decent, I’m truly surprised to see the level of work they’ve put in to launch the card for the affluent Indians.

Yet, I still feel they could have done bit more when it comes to airport benefits like Airport meet & greet + airport transfers. Maybe its a food for thought for something like AURUM Travel credit card 🙂

While I’m waiting for the card to be delivered, you may expect the detailed review of the benefits and its worthiness within a day.

Which network is the card on and could you please share more on the milestone benefits and the movie offer (is it 1+1 or BMS gift vouchers)?

It is issued on both VISA & Mastercard. Mostly Infinite for VISA & World for Mastercard variant.

The BMS offer details are visible on BMS site now under “Offers” section.

Also on BMS site, under “AURUM” offer section, within FAQs you can see the bin ranges for this card series for which the offer is applicable. Its: 530917, 478748

I’m guessing the card is available only on Master/VISA and not on AMEX.

Congratulations on your new Super Premium Card:) 🙂

I was not eligible, but when I logged into SBICARDS, the website says We’ve registered your interest.

Will wait for a while before opting or requesting for an upgrade. Especially keen to know the reward rates on various categories.

Cheers.

Do you hold a sbi savings /salary account ? Post how many years of SBI prime did you get an upgrade? Please let me know

SBI Cards is an independent agency. Upgrade is purely based on usage history + CIBIL score. For upgrade you’ll need a good usage history of minimum 6 months & you dont have to necessarily hold PRIME card, any SBI Card with good usage is enough.

This looks dope. The only unfortunate thing about SBI cards is that they’re never free, no condition for it unlike credit card offerings from HDFC, Citi etc.

Sid,

Seems good. I am waiting for reaching 5 lac milestone benefit of my Prime card. So far 443000 ve crossed. Once reached i am planning to go for this.

I was getting this offer on 29th January but now not showing up. Dont know the reason

Btw holding SBI simply clik with decent limit from last 5 years.

This card is costly .will like to keep simply click for amazon and Aurum for big spends.

I also got upgraded from SBI Simply Click Card with a limit of 4.46 Lacs.

To clear the air, how one gets invited is a bit of mystery.

In 2015 I had SBI Elite Card, then downgraded to IRCTC Platinum and then side-graded to SBI Simply Click Card. The usage (except on SBI Elite in 2015) has been pretty nominal, I am mostly an Infinia Fan these days. Average expenditure on SBI Cards has been around 1.5-2 Lacs / year.

Earlier they had shared tracking number for Blue Dart, but now they have changed courier as “Hand Delivery”.

Fingers crossed.

Do you hold a bank account with SBI too?

Yes. But I doubt if it made any difference. Anyway they earned enough on my educational loan, so I consider it to be their thanks giving now 🙂

Anyway not to worry, it should be available to most soon.

Great! Thanks for reply @sid

Hi sid

Thank you for keeping us informed about credit cards.

Please let me know should I upgrade my sbi prime card to elite?

Or downgrade it to sbi simply click. As I don’t travel much and use my card occasionally.

Dear Sir,

Please continue the good work you are doing.

I am working in Govt sector. using sbi credit cards since 2013.

Now holding sbi simplyclick since may 2021. Before that i had sbi prime for 3 years. Avg spend: Rs3.5 L/ annum. I have few queries on SBI Aurum card. Hope you have time to answer it all since SBI Aurum helpline people have refused to answer my email by a phone call. The lady stated that it is an “invite only card” and hence we cannot give details or brochure. Since you are holding this card, kindly answer to the best of your knowledge or guess since you are an expert in this field.

1) What is the annual ITR requirement for SBI Aurum card?

2) What is the existing credit card limit requirement for SBI Aurum card?

3) What is the annual spending requirement for SBI Aurum card?

4) Whether reward points can be adjusted against card fees like in Prime & Elite?

5) Is there any issue in upgrading to AURUM card from SIMPLYCLICK?

6) How many add on cards are permitted for AURUM card?

7) Whether add-on-card holders also will get domestic lounge access within the total of 4 nos. per quarter?

8) Whether add-on-card holders also will get unlimited international lounge access?

9) My SBI card anniversary is July 11. Along with the next bill, a card fee is levied. So whether for AURUM card also joining fees will be levied immediately on receipt of the card or only in the bill after anniversary date?

10) Whether Amazon Prime subscription, Discovery Plus subscription, Zomato Pro subscription, EazyDiner Prime subscription, bbstar membership, Lenskart Gold membership wii be available for only first year or all years on paying annual fees?

11) What are the concierge charges for different services?

12) How many times in a month can I use concierge services free of cost?

Regards

I was looking to downgrade my card from SBI Elite to the BPCL one, but was told that I can’t go from a regular card to a co branded one. Will move to Simplysave now.

Where did you check the eligibility for upgradation? Or was it on the homepage itself?

Where can we find upgrade option/ where to check for upgrade in SBI card portal? I am SBI ELITE card holder

You can go to services option in sbi card app. Under that you can see upgrade card option.

Thanks Arif. I didn’t find any option like that. I tried in both app and website

Go to website -> Go to benefits -> U will get option there

Off topic… My SBI Prime limit is 1L now, recently I have moved to abroad. Can I req for increase in Credit limit using Abroad income ? .

No, if you tell the bank that you’ve moved abroad, the bank will close the card instead and you’ll be left with only FD lien based secured credit cards.

Oh thanks.. i almost did it.

Can you help me any idea for credit increase ? I can’t show my abroad income!

I’ve been using Citi Premier Miles card (mostly online) while abroad for nearly 9 years and Citi kept increasing my limit and I was handed with almost 6L during the tenure. So IMO, keep using the card and you will see it coming.

I’d hold it just for the looks. What a beauty!

Shivi, you read my mind on that….

Infinia/reverb DCB are far better than this. SBI cards as some one pointed out are never free. It does not make sense to pay 10000+18% gst for 1% reward rate.

Axis Ace card with 500 fee has 2% reward rate and same number of lounge visits.

Further SBI is notorious with reward points value redemption.

When SBI signature card ( current Elite card) was launched reward points valued at Rs 0.25. further there was an option to redeem as cash credit.

Current value per point is Rs 0.08 or even less. No cash credit option.

In such scenarios it does not make a good option to hold at such a high cost.

The cash credit value is still 25p. Just redeemed 8000 points for 2000 rupees yesterday on sbi elite

where was the option for cash credit? can you post link or how you could it.

You need to call the call center to redeem points for cash. Value is still 25p

This would be too far in my case, irctc RuPay they didn’t issue to me

I just have Ola SBI now, being co-branded less likely to receive any invite

Sid, can new customers hope to get their hands on this card at this stage? I never held SBICard cards till now but have good ITR that got me an Infinia and YFE.

Hello Siddharth,

Sorry for going off- topic but I have to ask you this. I just got an offer to upgrade my Hdfc Moneyback Credit card to ‘MC World Regalia Card’. Not sure whether it is LTF or not. Should I take this chance?

Go for it.

Mostly its FYF.

Isn’t 1% reward on regular spend too less for a ultra premium card ?

Even basic flipkart and Amazon cobrand card gives better.

I have a regalia and it’s 1.3% if I use it for flight tickets, around 0.93 if I use it for Amazon/flipkart voucher.

With 10x rewards through smartbuy, and milestones, it ll even more.

I am dreaming of infinia/diners club. The value proposition looks a lot better. Upto 3.3% on normal spends.

Thanks for the timely update on this card, Sid. Honestly, I don’t believe this card is worth to upgrade from SBI Prime. I am holding SBI since 2-3 years now and I am able to get a huge return which is nothing compared to what this card offers.

I hope you can get the most of that card.

Cheers!

I think it will available soon for all. Why would one pay such amount if many banks are giving ltf to HNI customers.

I have Sbi prime card and its renewal is coming up. I am cancellig the card as I have not been able to spend even 1 lac in the last year. The primary reason for taking the card was rent payment which they removed. I had some large payments in the first year which covered the renewal as well as milestone but unfortunately they dint honour the 5L milestone benefit. Diners black and amex mrcc have spoiled me for the rewards they give and prime card doesnt seems that much useful infront of them. I also have simplyclick card which will cover the time to time sbi offers I need. Have applied for axis ace card which should cover the utility payment cb at much lower annual fees.

Shahil, How are you earning Huge Return from SBI Prime Card? Birthday Benifit is also reduced to 2000pts. Wondering how you are fetching huge returns. Can you please explain?

Hi Bharat,

That limit is for the SI, not the birthday benefit. I have received the relevant reward points in Aug 2020. Can you please provide the source of this information. I am not aware of any changes to this.

Thank You.

Pls go through. the comments for the SBI Prime Card article in this blog.

When HDFC is offering LTF DCB and Infinia, who will pay 12k for this card. Absolutely not.

Hdfc Is not offering any more.

Dcb and infinia are rewarding in airmiles, and this is in statement credit, that’s the difference

Got the upgrade offer but not sure if I want to upgrade my Simplysave “Signature CC downgrade” yet.

My 5lac CL maybe the reason why I got the offer or the 9lac CL in my old SBI Signature CC. Either way the 40k points means 10k but the GST will be extra and the only real plus is the discovery+ membership “Already have amazon”.

BTW This card has points to statement credit ‘@0.25’ like other SBI CC’s right ?

I don’t think you need 5L to get the invite. I also got the upgrade offer on my sbi simply click which has only 3L limit as I barely use it and hasn’t had any limit enhancements since I got it like 5 years back.

For most people it makes no sense to get this card when there are numerous alternatives with better reward structure and are LTF. Might make sense for few HNIs though.

I agree. The spending requirement of 12L is just too much for annual fee waiver which is 10k. With Covid-19 most international travels are limited these days to enjoy the lounges. Further, most benefits are overlapping with most other premium cards and rewards structure of other cards seems better.

Do we get 40k points as welcome benefit?

Yes.

The offer in upgrade has changed from Aurum to Elite “Valid till March 2020”.

The BM says you will get Aurum offer post March as they must have run out of slots for you. Overall I am still confused on if the card had the statement credit and no one gave clarification on the same till date.

No bank is coming out with Infinia kil*er offering.. This was a time as hdfc cannot offer new products.. acquire new customers!!

Totally inexplicable.

Aurum is stillborn!

Congratulations on Your New Metal Card from SBI , looks splendid.

I have been trying to upgrade my SBI BPCL Card for quite sometime now and everytime I get a list of cards including Elite and Prime as available upgrade options from the customer support through mail but at the last hurdle of approval process I always get an eMail stating regret to inform you that your card upgrade request was denied without any additional information as to why the request didn’t go through.

PS: I had held an SBI Prime Card until about Mid 2019 and cancelled the same as most of my usage was shifted over to AMEX & HDFC Cards.

Co-branded cards are usually not eligible for upgrades

SBI wont let me cancel my Prime card. They gave 12,000 points which they converted immediately to cash worth 3000 (less 99+gst) for retention. I was like HUH!!

Hi Sid,

Still, details are not updated in SBICARD website. However, it is already updated in BookMyShow website. 1000/- worth tickets per month.

That’s what Indusind give you on debit card!

Lol, Amex Platinum Killer? Can’t even compare this to Gold CC!

So, after applying for an upgrade on 29.01.21, I finally received the card along with the addon card thru Bluedart.

The card looks cool, similar to OneCard except for the Golden engravings.

Can you please confirm if we can redeem the 40000 points for cashback, like other SBI cards?

No, not possible with AURUM.

Hi @Siddharth do double check this from customer care because my BM says the points functions are the same as elite and can be redeemed four statement credit @.25

The BM is pushing me to apply offline where as the upgrade has changed from online sbi site to elite card.

Have checked twice on this. Cash credit not possible on AURUM. But Amazon Voucher is there, so nothing to worry.

Existing SBI card members can express interest while logging into the aurum login page with their existing credentials.

Great. it worked. waiting to see any response. it is good to see ‘sbi log in details are working on AURUM to show the interest for card.

Today when I tried to login to SBICard, the login page was redirected to AURUM. I entered my credentials and there was a message “Thankyou for your interest in AURUM credit card. We will get back to you” and it was again redirected to my card account.

Please give me the helpline number of Aurum card

Its 18605002000

I gave a request to upgrade my card a week ago but I still haven`t got an acknowledgement/virtual card/request number yet.

Please advise the further steps