Online rent payment space seems to get great traction lately even during the times of lockdown when everything else appears to be still. We’ve recently seen CRED launch it’s CRED RentPay and Redgirraffe too came up with a great cashback offer on HSBC credit cards.

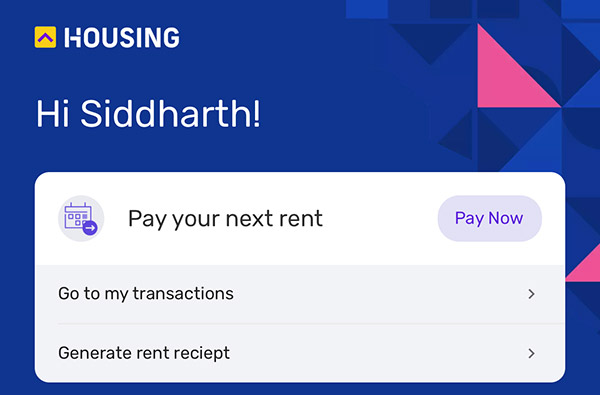

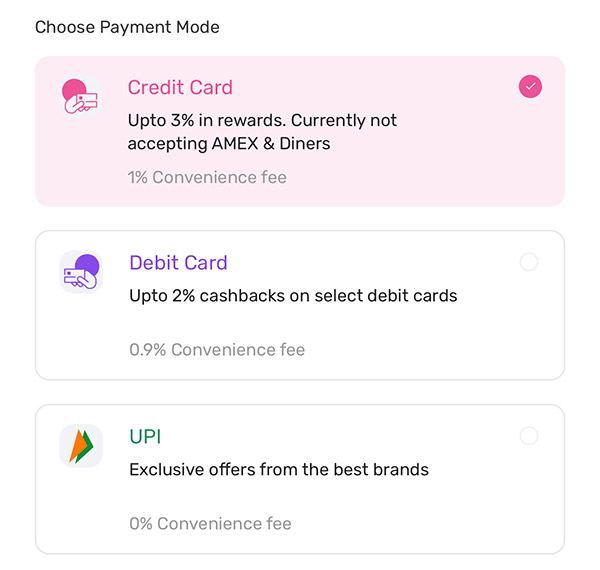

Now Housing.com has launched the ‘Pay Rent’ feature on its mobile app to facilitate rent transfers using a Credit Card, debit card or UPI. The product is currently ‘app-only’ and will be launched on Housing.com’s website in the near future. Here’s everything you need to know,

Table of Contents

Overview

| Description | Value |

|---|---|

| Service Fee | 1.3% (Credit cards), 1% (debit cards), 0% (UPI) |

| Min. Rent | Rs.3000 |

| Documents required | Nil |

| Rent Settlement | ~1 Hour |

Rewards

The above values explains everything you need to know. Plus, apart from settling payments almost instant, you also get rewards instantly upon payment, similar to how CRED works.

During my test, I got these rewards, post payment. You may use those coupons if you wish.

What’s the Process?

It’s neat & simple in 4 steps.

- Enter Your details

- Enter Your landlord bank details

- Enter the property details

- Enter Payment amount & checkout.

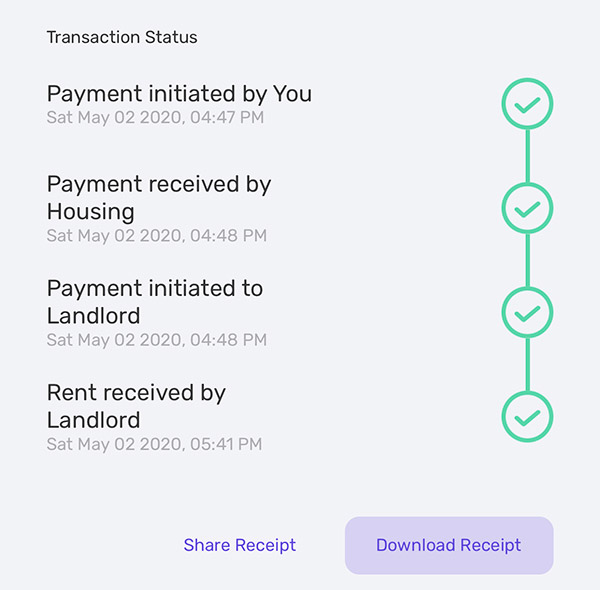

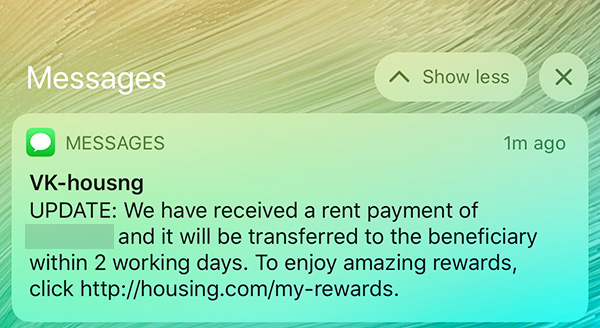

They use razorpay for payments, the UI of which looks great as always. Payment was transferred in a hour to landlord via IMPS during my test.

You can also download/share the rent receipt, which is a plain copy of the payment info in few lines. Here are some screenshots for your eyes:

Bottomline

- Cardexpert Rating: 4.3/5 [yasr_overall_rating]

Overall it’s a great product in terms of: nice UI, quick settlement, no paper work, etc. Its certainly one of the best rent payment app to pay rent online using credit card in India.

However, if you need to use American Express or Diners Club credit cards, you may still have to rely on Redgirraffe (accepts Diners) or CRED (accepts Diners & Amex).

Further, if you pay rent via Housing app, you get rewards at 3 points: one from housing, two from Cred, three from credit card issuer.

So its hightime for every Indian to move the rent payments from default NEFT mode to credit cards so you get higher rewards, ~45 day credit period and a lot more.

Have you tried Pay Rent feature on Housing.com’s mobile app? Feel free to share your thoughts in the comments below.

I used it to pay for the current month’s rent. The experience is seamless and settlement is quite quick. I received the confirmation of payment in couple of hours. incidentally, I was not charged a convenience fee for payment with a visa credit card. though I feel it might be a one-time promotional thing and charges will show up for next month’s payments. Never tried creds rent pay portal until now.

@Shanu Which is your credit card ?

I paid with ICICI amazon card, Amex and Diners didn’t work.

that’s because they ran promotional offer of 0% charges from April 29th to may 1st 11:59 pm, so who transacted during that period availed that offer, btw when did u pay your rent?

Cred is charging more than 1 percent as transaction fee, which is keeping me away.

Rent pay feature in Nobroker is also seamless with 1% transaction fee and for this month offering 5% cashback upto Rs 500 using Payzapp. The payment was deposited within an hour.

I mostly use RedGiraffe, and use Nobroker only when there is a change from the normal rent amount.

How does the Nobroker Rentpay links up with Payzapp, especially for a Rs 500 cashback?

Its a promotional offer..no code required.You need to be a payzapp registered user(minimum KYC/Full KYC must) to get this cashback.

can we use diners under PayZapp to pay for rent through no broker ? if yes will we get points for dcb?

Do anyone got the answer to this ques. i.e. if we pay using DCB on payzapp then we will get both 5% cash back & 2x points on card (got notification of same).

No. Diners card on PayZapp is considered as a wallet load and would not accrue any points.

I use HDFC Infinia and getting 3.3% on rent payment by paying 1% is a great deal. Housing rewards is a good bonus on top of it.

RedGirraffe charges ~0.4% which is even better. I use my Diners for my rentals.

Does, Hdfc Bank credit card give reward point of payzapp transaction

Hi, do you hold life time free infinia card? how do you got it? Is there any criteria to get that card? I hold regalia card since 4 years.

I paid my rent two days back on housing and I wasn’t charged. Used indusind pinnacle and got 2.5℅ . They have introduced 1℅ charges now.

Are they asking for rental agreements to be uploaded?

No, hence these apps getting popular 😉

what if diners cards are added previously under our razor pay mobile number, I didn’t transact but just checked with razor pay otp authentication, where I clearly saw my diners card under added section, will transaction fail if chose to pay with diners?

How about using housing.com to make other payments?

There is an offer of Rs 500 cash back for paying rent through no broker.com and PayZapp. Offer valid till 31st May

I don’t have landlord PAN. Can I pay rent through nobroker for one or two times only?

Yes you can

Hi Siddharth

Can you explain how the 3 point reward system work? Paying through housing how does one gain cred coins?

By paying that CC bill via CRED.

Ahh got it

Thanks

Btw, where are you using Cred coins? I have around 5 lakh coins but don’t see anything worth spending on.

Choice of platform as of solely depends upon one’s current feasibility:

1. If landlord Pan card is not available then No Broker was the best option till now (While back they stopped accepting Amex and Diners, hence for these users it was the best). This platform is also good if one wants to transfer irregular amounts every month.

2. If landlord Pan Card is available and if one has a visa or Mastercard super premium card then hands down Red Giraffe wins it.

3. If you don’t have a rent agreement then housing/cred app.

Please note, payment done on NoBroker using Amex doesn’t accrue MR points ( txn is marked as PayTM Utilities).

Found this the hard way this month.

Between Diners Clubmiles and Amex MRCC, which would be a better card with which to make rent payments ? With Amex, I am informed that CRED rent payments don’t attract reward points, but qualify for spend milestones.

I suppose I’ll be using RedGirraffe, but wondering whether diners clubmiles payment will qualify for reward, and whether payzapp payments will work the same way?

Housing just increased CC charges to 1.25%.

Debit card to 1%.

Housing Started with Fee of 0% moved to 1% till yesterday. Today it went up to 1.25%. If looks like they will go higher with Fee day by day since they introduced the rent payment option.

Now charges increased to 1.25% from 1%

Cheers,

Kiran

Both CRED and Housing did not work for me. While using CRED it doesn’t seem to accept ICICI account numbers and simply says account details incorrect. For Housing, everything went in smoothly but I got a red ! sign in “Rent received by landlord” part and got an email that money is being refunded to card. Will try NoBroker once before paying rent through RG.

Neither CRED nor Housing seem to have a real chat support (let alone phone support) for this service. RG has proper customer service and costs 1/4th.

@Amex Guy:

Tried Nobroker for the first time on 3rd May(Sunday). Was extremely smooth experience. Rent got credited to owners account in 10 minutes. Also, they had live chat support available on their website & they answered my queries within 3-5 minutes.

Even Syndicate bank account numbers are showing as account details incorrect.

Amex Guy,

I am sure you know , payments on NoBroker wont accrue Amex MR points. ( In case you had the 2x points promo in mind) 🙂

Redgiraffe is asking for rental documents and Electricity or water bill with owners name.

Any we use these rent pay services (housing and cred as they are not asking for rent agreement) to get temporary credit from our card at cheap rate or in short to achieve milestone spend as this money can then be used to payback the credit card bill.

Will it have any legal implications?

ALL such transactions are considered expenditure, and would attract Income Tax Department’s scrutiny.

I know many who used this credit card encashment techniques by RENT PAYMENT methods/apps, to get cheap cash loans or to achieve milestones, but they got notices as their annual spends was above 2 lakhs on cards.

so when using rental apps just for cash/reward/milestone games, beware of Income Tax’s scrutiny.

now pan and aadhaar are linked and they use 360 degree software, where their software calculates all credit card expenses as expenditure and one will be obligated to justify such expenditure.

so be careful….

The maximum time for credit to landlord changed to 2 days. In nobroker, the credit is almost instantaneous. The charges in nobroker is also lower.

How do they make sure that i am not transferring money to my own (or friend’s) account?

They don’t. You can even transfer to your own family members. But there are charges involved and misuse may cause rent pay websites/ banks to wisen up and stop these payments or put up conditions/ limits.

Weird for me : Could not pass thru’ step 2, throws me an error that IFSC code is incorrect, tried in two devices having same problem. Is it just me or for anyone else too?

Everyone has same problem !! Seems ..its taken down !

Which payment site.. Housing or no broker

Same problem I am facing for the past 5 days

Yes. Housing App is not working for Rent payment.

It is giving error like, IFSC code is not valid. Tried in different mobile devices also.

Even some time getting error like “something went wrong.,plz try again” .

Hi, I need to pay my hostel fees ie yearly fees. Can I pay through this? Considering my hostel is my landlord and rent is fees.

The hostel account is a current account. Need opinions.

Technically you can. However, I would recommend you to send them an email officially. What could happen is that they may see you use a card for a large transaction and nothing for months and assume misuse and black your account and all your hard earned cojns.

Even I m also getting Ifsc code error in housing App.

I tried in two different device also. It’s not working.

Sometimes error like “something went wrong, try again letter ” error I m getting.

So I m not able to do PayRent in housing App.

Update: Checked with the Housing, looks like service should be up tonight.

Now it is working fine….I have done the payment today.

It’s surge pricing. Charges have gone up to 1.30%!!. It’s the costliest option out there compared to other options.

Red giraffe and nobroker is lesser but Cred is higher with 1.5%.

Is there any other options with charges around 1%?

Hi Sid

They’ve now raised charges to 1.3% for all payment modes. Cc, Dc & even Upi.

Seems they are struggling to cover their costs and are constantly increasing their charges.

Hi,

today I paid rent from NoBorker App with Payzapp account . But I didn’t received cashback in my Payzapp wallet.

It takes 90 days for the cashback to be credited in your Payzapp wallet.

It takes 90 days post transaction.

Can anyone plz suggest any alternative for using Amex card on Payzapp ?

Payzapp accepts Visa, MC, Rupay, Diners but not Amex.

Seems HDFC has some old grudges with Amex !

Payzapp has some very good cashback offers of 5% & 10% on bill payments Every month, which aren’t there on Amazon & Paytm (every month).

Plz share if anyone has a way to this..

Regards.

I faced an issue with Nobroker or nobroker pay rent they eat our money with service charges and penalty,

I paid rent through Nobroker, after paying rent. Now they asking rental agreement & Owner details.

I asked my paid rent amount to return back, nobroker customer care team saying they will detect with service charges and penalty,

to return back my money.

it’s very horrible without transferring rent to my owner how they will detect the service charges.

so be aware while using nobroker paying rent, don’t lose your money.

In how many days the fund got reversed ?

i paid rent through Housing.com using credit card, amount is deducted and not credited into landlord account, and in housing.com app my transaction history is not showing , i sent mail to support team , they have not given any response by sending simple greetings mail, how can i get resolve to get my money.

They have reduced the fees for below 20K to 1% now. and above remains the same 1.3% . Makes it more interesting option

Till 25K its 1%

How much minimum and maximum amount will be transfer per month

i guess you can transact 2-3 times per month. on rent amount i guess no cap

I have paid my rent through the credit card and in the housing app the status is showing that the amount got credited to the bank but my bank is not reflecting the same. I’m very much worried about this. When I tried to call customer care they say that their offices are closed and now we cannot talk to them

I am blocked by Housing, what should I do?