The ability to pay income tax online through credit card is great to have and we got this option in India since past few months. I just made a tax payment through credit card and it was a super smooth process, thanks to IT authorities for making this possible.

Here’s everything you need to know about making income tax payments (advance tax, TDS, etc) through income tax eFiling portal.

Table of Contents

Steps to Pay using Credit Card

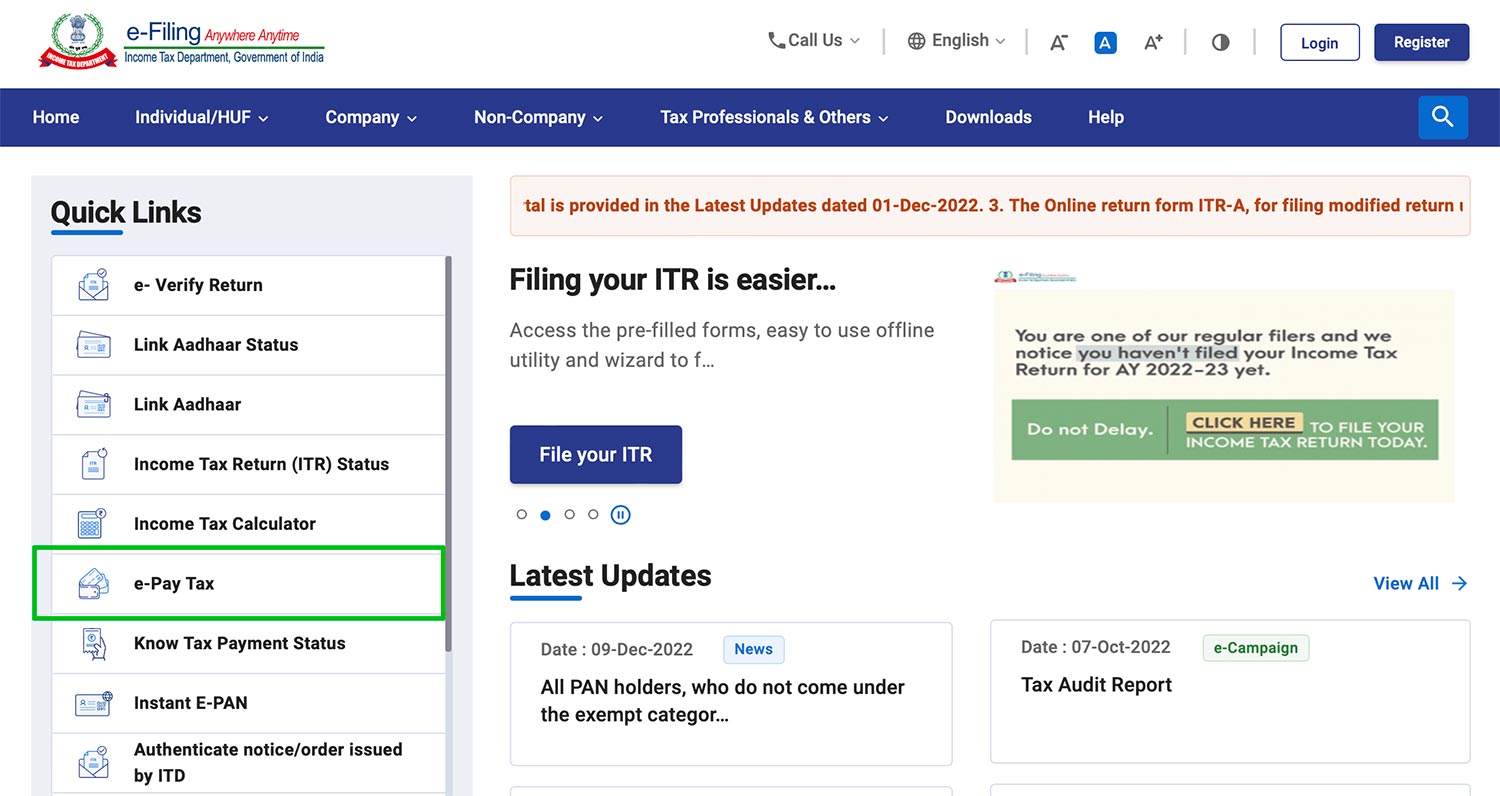

- Visit IncomeTax eFiling Portal

- Navigate to “e-Pay Tax” section on the left

- Enter your PAN/TAN details & authenticate mobile # via OTP

- Choose type of tax, then choose FY/AY & other details

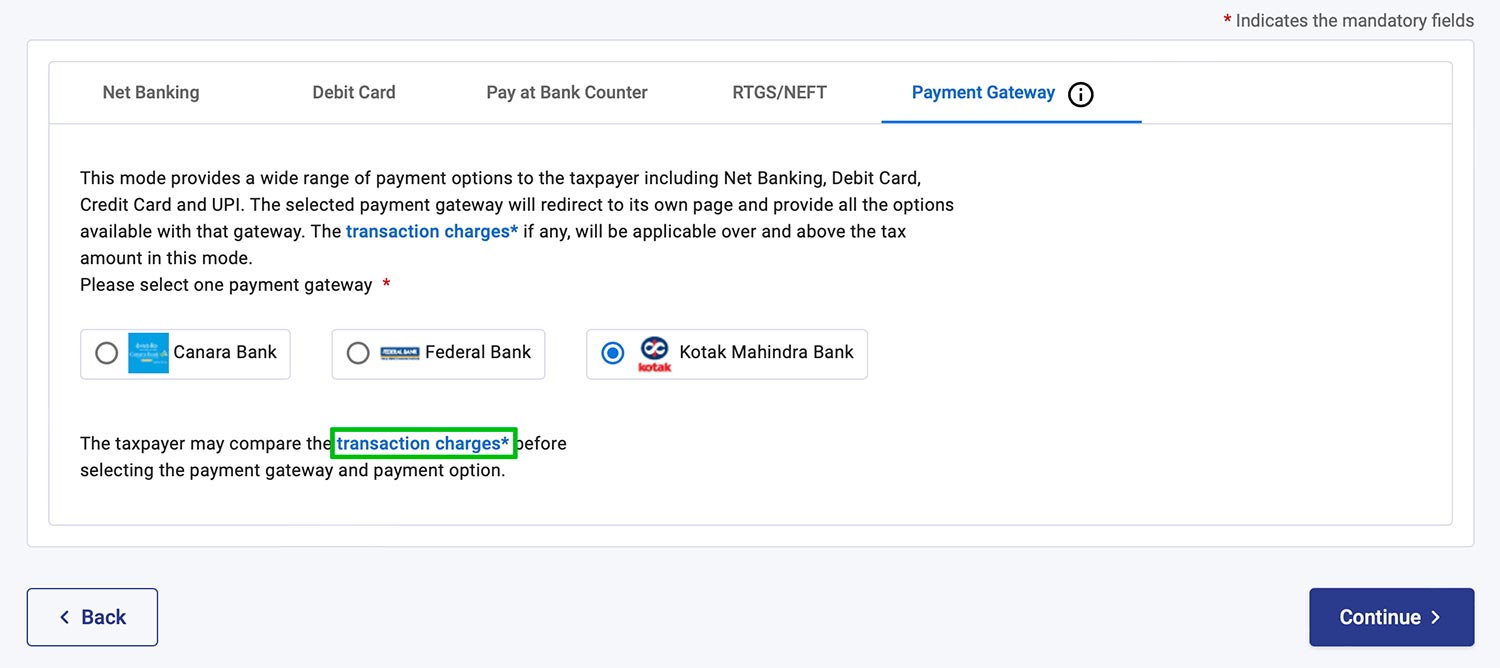

- Choose “Payment Gateway” & make payment

Note: Choose the payment gateway based on the txn charges. You may find the respective gateway charges by clicking on the “transaction charges” link.

Here are the snaps of key pages for your guidance:

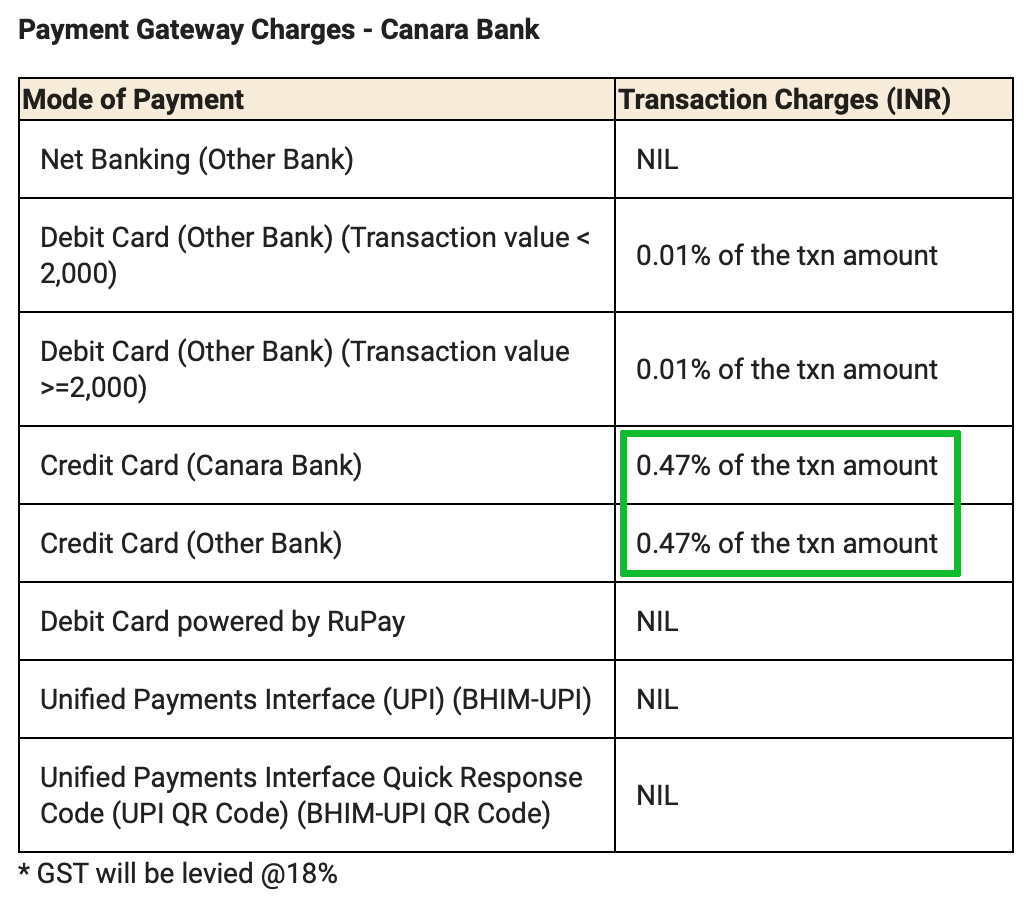

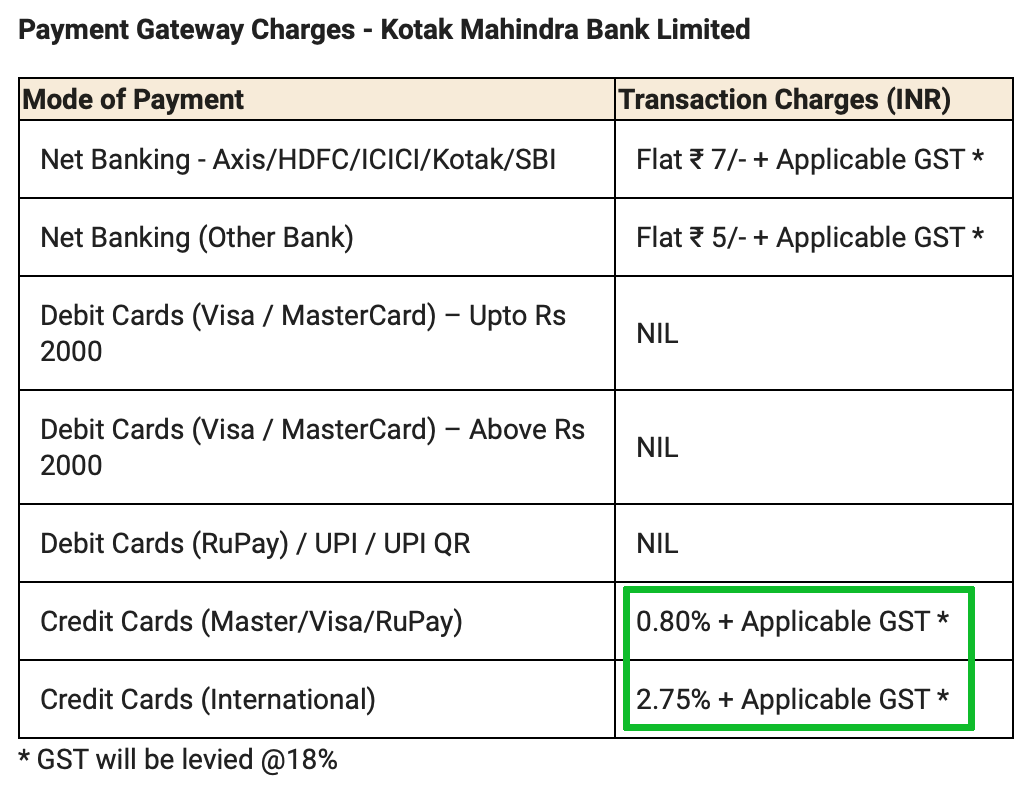

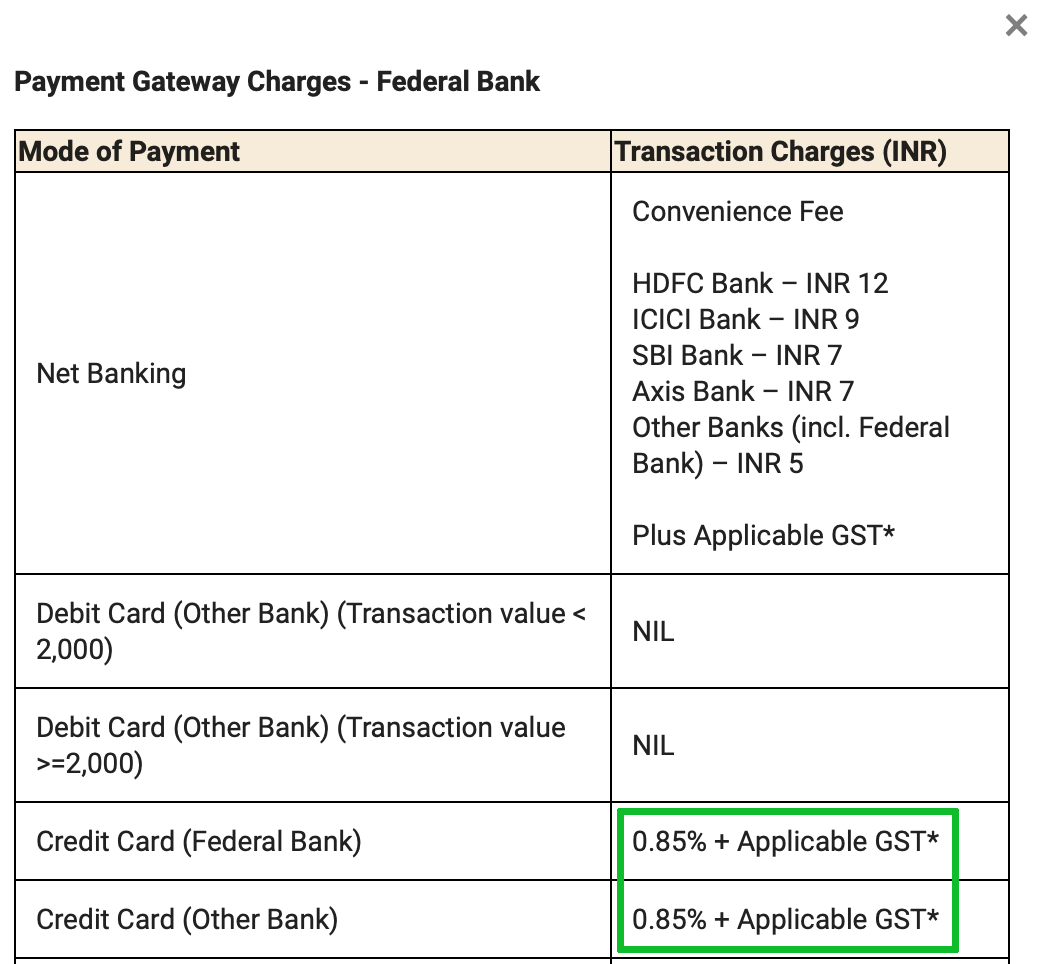

Transaction Charges

- Credit Cards: As low as 0.47% + GST (Canara Bank)

- Debit Card: 0% (mostly)

Note that the transaction charges are different for different payment gateways and that the charges are dynamic and keep changing from time to time.

As of today (14 Dec 2022), Canara Bank payment gateway has the lowest transaction fee. Do verify the same before choosing the payment gateway and re-confirm the fee on the next step.

Here are the current charges as of Dec 2022 that I see on the portal.

Why Pay via Credit Cards?

Paying taxes through credit cards does attract a small transaction fee. So if you’re new to credit cards and ask me “Why pay fee?” Here are some of the reasons,

1. Annual Fee Waiver: If you’re holding Premium credit cards, it comes with an annual fee waiver condition based on spends of “X Lakhs” in a card anniversary year. These tax payments can get you closer to it.

2. Rewards: While most Credit Cards may not give reward points for government transactions, you may just use it to avail at-least the milestone benefits.

For ex, a tax payment of 1.2L INR on Axis Vistara Infinite Card will not only get you a free card but also a free business class ticket + 10K Points equivalant to another 2 economy tickets. That’s 3 flights for Free!

If you do not have credit cards with milestone benefit, all you need to do is to make sure your credit card regular reward rate % is more than the txn fee % that you’re being charged.

If you’re looking for credit cards with high reward rate, do check the list of best credit cards in India at the moment.

3. Additional Credit Period: You can easily get 30+ days to pay back your credit card bill, so it’s an added advantage just incase if you’re in a cash crunch. If you’re paying EMI/interest for loans, consider it as a cheapest loan for a month.

If you still feel that you don’t wish to pay the transaction fee, you may also choose to pay with debit cards at 0% fee. While you may or may not get rewards, this will help to keep the debit cards active.

My Experience

The user experience was ultra smooth while making advance tax payment on the Income tax eFiling portal.

I’ve used Axis Magnus Credit Card this time to get closer to current month’s milestone benefit. You may as well use any card that gives decent milestone benefits.

Note: Use HDFC Credit Cards before 31st Dec 2022 to enjoy the rewards, as the HDFC reward structure changes kicks in from 1st Jan 2023.

Final Thoughts

It’s great to see that the government has not only taken steps to include credit card as a payment option for making online tax payments but also implemented it pretty well.

This is a great option for the citizens of India but appears to be not so great for banks, as both Axis Bank (eff. 15 Nov) & HDFC Bank (eff. 1st Jan) recently notified it’s customers that they will no longer give rewards for the government transactions.

That said, it’s still beneficial in many ways as mentioned before. Finally we’ve a reason to pay taxes on time. 🙂

Have you paid taxes using your credit card? Feel free to share your thoughts in the comments below.

Thanks. I have been waiting for this article.

Which all cards are good (considering milestone and rewards) for government transactions?

I paid 50k as advance tax through my amazon pay credit card on 7th december. This is the best way to reach milestones through credit cards especially for people paying in lakhs in taxes in 30% slab like me.

I paid through canara bank gateway which means I get 0.53% as cashback which is unheard of in probably tax paying history. Amazon pay is probably some of few credit cards which will give you cashback for govt payments till now. Have to see which credit cards are going to stop in future. I have diners club privelege, sc ultimate, eterna . Will be trying these in next few months for more cashback.

Is amazon pay still giving 1%? Are yes/au/indusind etc banks giving points?

Are amex cards accepted?

No. Amex is not accepted.

I knew about this facility and had made by Sep and Dec advance tax payments via my Infinia card. Did not pass the word around as I feared that the HDFC Bank would make them ineligible for reward points if they say increased usage of this facility by clients. Nevertheless, this now comes into effect from 01.01.23. Hence I would commend you for releasing this article at just about the right time given that tomorrow is the deadline for advance tax payments.

HDFC Diners black card doesnt work on this. Just tried it.

Axis Magnus gives reward points or doesnt?

You mentioned Axis wont give rewards from 15th Dec for govt transactions, is it true for Magnus also

Magnus still getting rewards (from what I hear) for these txns but it seems more of a soft rule. May change anytime.

As a follow up to this, I paid with my Magnus for income tax on 14th. Now the points are showing updated till the 15th and I have not been given edge rewards for the income tax paid. Can anyone confirm if they have been given edge rewards?

After speaking to customer care, the points on Magnus were credited pretty much instantaneously for advance tax payment.

Was waiting for this article as this was announced way back but wasn’t live. Only issue is many cards exclude govt payments and taxes from rewards. Maybe readers can contribute with list and details of cards best suited for this category.

Great . Now thanks to your post everyone is gonna do this , making it unviable to banks and all remaining banks will go HDFC way and disable points accrual on govt spends.

In this age, it is not going to be hidden. Someone or the other will post it..

SBI, BOB, Axis and HDFC implemented no points or lower points on govt spends since nov itself even befor Sid’s article. Because in September lot many people paid taxes using credit card (including myself).

Govt spends were curtailed far faster than rentals despite more people paying rent!! Thats the surprising bit

Hi Siddharth, r u saying axis Bank will not give rewards for tax payment for all axis Bank credit card from 15th nov onwards? I am asking this bcz i paid advance tax using axis Ace card on 30th Nov. I got 2% cashback confirmation sms after the transaction.

Hey Siddharth,

Did Axis Bank remove points on Government transactions on all credit cards? I had a look at their PDF and there is no mention of Magnus or Reserve.

Also, looking at miles transfer considering United miles as 0.8 INR, doing tickets through which card is more favourable? Infinia, Magnus or Reserve? I would probably not do transfers on Infinia though.

Will SBI cashback card give 5% for this?

SBI gave 1% cash back instead of 5% on the cash back card.

Hi Sid,

Thanks for timely article. Will i get regular reward points on Infinia if I pay on 15th Dec?

Yes, you’ll get.

Thanks Sid, great article.

Is Magnus giving regular edge rewards on NPS payment?

Magnus is untouched on any type of spend as far as I know (i’ve not tested NPS), but we can expect anything to happen any day!

Kotak cards were levying NIL charges 2 months back AFAIK.

Currently Canara bank gateway is best. Used that to pay Advance tax last month @0.47%+ GST.

Timely article and a nice one at that 👍

NPS tier II has already stopped facility of credit card transaction

Does contribution to NPS Tier 1 Constitue as a govt transaction…If possible write an article on the changes of reward payment of HDFC Diners Black… Rent pymt…etc

Axis Flipkart gives 1.5% cashback , this is better than Amazon Pay 1%, but not sure if works for IT payment…, if anyone tried, please share the experience.

Sir what are changes in hdfc reward structure from 1st jan 2023?

Hi Sid

Are Amex cards accepted?

I have a 5% spend based offer and this will certainly be beneficial even if they don’t accrue points on the spend.

How do you guys pay tax via credit card? Does your company not deduct tax from your salary before it credits in your bank account?

Many people have to pay taxes by their own either because they are self employed (non – salaried and/or involved in a business ) or they have additional income other than their salary.

For self employed.

For salaried – it is mainly interest, dividends, capital gains and other income which are not reported in salary but are taxable

No capping on reserve on tax payments. Personally confirmed

Will Axis vistara infinite give CV points for tax payment and will it be considered for 1.2 lacs fee waiver criteria. Pls confirm.

Can some one pls respond to my above query.

Same question. Did you try?

Can you please elaborate that HDFC and 01.01.2023 thing?

Axis Ace & Flipkart cards are providing regular cashback, i.e. 2 & 1.5 % respectively.

Just tried now & received SMS for eligible of cashback.

I paid using Canara Gateway Rs. 65000 (axis vistara infinite) and it charged less than Rs.400

I will get 1900 Vistara points which equals = 1950 – which equals 1500 Rs

and I paid 400, so net profit = 1100 + meeting the credit card milestones.

Could you please confirm that you got the cv points.

Thanks

I can confirm that i got CV points.

Axis vistara infinite looks best for this? If I have tax payment for 30 lakhs?

I am searching for the same answer. Axis ace and axis vistara i suppose are good options. What do you think?

Read above that “This is a great option for the citizens of India but appears to be not so great for banks, as both Axis Bank (eff. 15 Nov 22) & HDFC Bank (eff. 1st Jan 23) recently notified it’s customers that they will no longer give rewards for the government transactions.”

Is this in place – can’t find anything mentioning this on the Axis website.

Which card is useful for tax payments? For getting reward points or cash back.

Starting April 2023, even Standard Chartered Ultimate is reducing the reward points earn % from 3.33% to about 2% for government spends.

Which card then is the best to use for paying taxes?

Is this still working? Only two options are visible as of now, unlike earlier.

Only Net banking & debit card options are visible

Are you sure that you checked under main income tax portal? I was able to use CC last week.

Hi Sid , Please let us know best card for Govt. Tax Payments .

Thanks

canara bank payment gateway (which was charging only 0.47% as convenience fees+GST) for credit card payments has been discontinued in the income tax portal. while HDFC payment gateway has got added, all of the existing ones charge 0.85% + GST. Is it just me missing the CB gateway or has it been removed ?

Any updates on this article? Which Card/Bank is most beneficial nowdays for Tax payments?

Canara bank is back , and always check the transaction charges which are clearly displayed before you choose your gateway , have a look and choose

Great article Siddharth

Please post an update on this topic after HDFC & Axis policy changes

Hi Siddharth,

I hold multiple credit cards… Any thoughts on the best card to use to pay tax?

I have diners, ultimate, regalia, icici amazon pay, idfc wealth, yes exclusive,amex to name a few.

I don’t have infinia and magnus..

Approx tax payment will be 5-6lacs.

Thanks

It seems hdfc/axis/sbi don’t let you accrue points..are there any other cards that let you? It seems it used to work on Amazon pay..can someone confirm if it still does? Also do other bank cc like yes/au/indusind etc also let you?

Standard Chartered Bank CC gives reward points on tax payment.

which credit cards are giving reward points on tax payments in 2023 ? if not what cards should one use for tax payment (Magnus,amex,icici ,hdfc,citibank etc)

Magnus gives

They best risk-free would be Magnus or Amex Gold charge.

I don’t think one can pay income tax via any Amex Cards, at least now. not sure about past. so Magus is the only choice. if anyone is able to pay tax via Amex cards pls let me know how.

Amex cards are not accepted for tax payment.

Canara bank gateway showing 0.91% charge + GST. SO, Kotak bank interface best now on eportal

Diners black is accepted for payment thru HDFC payment gateway… 0.85% charge. Not sure about reward points though, but I think, one can still use it to get monthly milestone benefits.

You will not get any points for using diners Black. Only option I found is using SC Ultimate CC.

Canara bank gateway says 0.47% but in reality charges 0.91% plus GST on payment page, so about 1.07% is charged.

Does tax payment via paid cards like SBI Vistara also not accrue any reward points ? Couldn’t find any specific exclusion on the SBI website.

Any card which fetches points for tax payments?

As of April 2024 any option of paying advance tax using Amex card?

Yes even i would like to know which cards are giving rewards now for payment or tax ,a little late to the party though.But better late than never.

IDFC First Wealth CC – N0

HDFC DCB Metal CC – No

Amex MRCC – Not Applicable

Axis Bank Neo CC – No

SBI CC – No

SC Ultimate CC – 3 RP’s per 150 spend

Thank you for the list. If we account the PG charges for CC which is about ~1% , even the SC ‘s RPs hardly make sense.