Indigo has been selling Credit Cards through HDFC Bank since past 2 years and through Kotak Bank recently. While the cards on quick glance does look decent, there are many pain points associated with the card in real life experience.

With a bit of inputs from an existing Indigo Credit Card (Kotak) customer, I can say that Indigo credit cards wont sell “well” in the market as much as it could. Here are 5 reasons why:

Table of Contents

1. Too many conditions

From earning rewards to redeeming them, there are quite a lot of restrictions. Here are some,

- Earned Points takes 90+ days to get credited to 6E rewards Ac

- You can’t redeem points for tax part of the flight ticket.

- Welcome voucher has its own limitations too

In-fact the person holding the Kotak Indigo card says that the points takes much more than 90 days.

So far we know these and I don’t know if there are any more unknown complexities. Such restrictions consumes a lot of our mental resources and it’s a big no if you prefer peace of mind!

2. Non-attractive rewards

:: Regular spends: 2% is bit low for an airline credit card, we should ideally get somewhere around 5% to begin with, in the airline rewards game.

That is how other airline cards like Air India and Vistara cards are designed as well, at-least the premium ones. Maybe Indigo could have had their premium cards priced at 5K or 10K for that matter, as that’s part of the reason too.

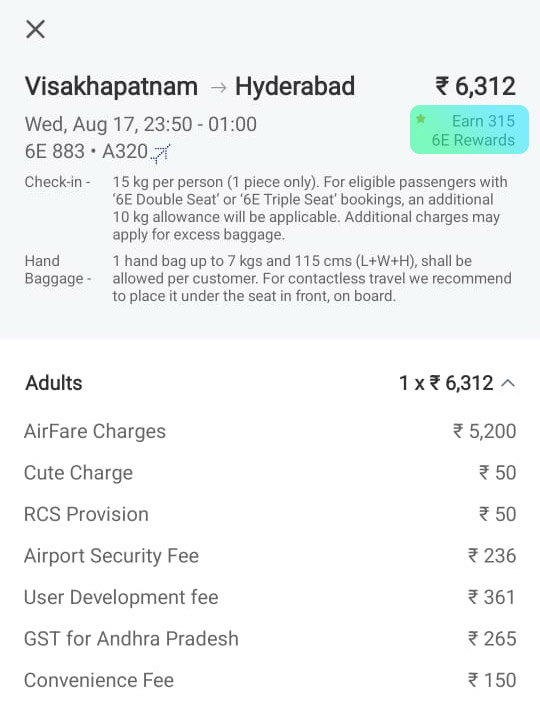

:: Indigo spends: While 6% (on 6E Rewards XL) is good on paper, points are earned only on “airfare charges” (excludes airport fee, GST, convenience fee, etc), so it doesn’t actually give 6% on airline spends, as below:

Same goes for redemption as well, you can redeem 6E rewards only for base fare.

3. Non-transparent rewards

While earning points is bit complicated as above, it gets even more complicated when you can’t see how many points you got for a txn, atleast on Kotak cards.

This can potentially hurt your reward rate in the background as you never know on what calculation the points are getting posted.

I assume neither Kotak nor Indigo will have this information readily available, if asked. Even if they have, we end users don’t have time for that.

4. No elite perks

The concept of “premium” airline card is meant to serve the frequent flyers with elite perks. Doing so the airline could attract some of the premium flyers flying with other airlines. But surprisingly Indigo XL cards have none of them,

- No free seats

- No free meals

- No free fast forward

- No 6E prime

- No meet & greet

I don’t know why they didn’t bother about adding some or all of these perks but it’s a big mistake in my opinion.

5. No USP

If you look closely, the card is just like any other cashback credit card, except that it is limited to Indigo and of-course wrapped with lots of t&c.

There is no major USP I can think of, other than the accelerated earn rate on Indigo spends, but that too is tricky as we’ve seen before.

End of the day, I don’t see a single reason to get the card while I can enjoy 2% cashback (direct to card) using Axis Ace and if I need to book a flight, I can anyday goto Cleartrip or other portals and use 10% or 20% coupons and book the tickets.

There has to be a reason for going through all the struggle but I don’t see any.

Final thoughts

These kind of cards never work out in the industry and we’ve seen it already with the HDFC millennia credit card, which the bank had to re-launch it by removing the silly limits for the card to shine bright like a diamond, well, at-least like a silver, no wonder it found a spot in our best cards list for 2022.

So, if Indigo and the partner banks decide to refresh the product, it may make sense. Else, I don’t think it will have a name in the history.

What do you think about the Indigo credit cards? Feel free to share your thoughts in the comments below.

Worst experience on this card so far (Dec 2021):

1) I had to make multiple calls and then finally Indigo agreed to write to Kotak that this card exists after months and then points started getting accrued

2) No Indigo voucher issued after close to 9 months of card delivery

I have asked them to share voucher by 6th Sep 2022 or close the card!

Update: received the one way code

I just got a Kotak Ka-Ching as I wanted a Kotak card and I did not like any in their line up. However, you are dot on target. Too many conditions, non-transparency, low rewards and lack of any USP will kill the card.

Btw SBI today killed HDFC Millennia card by launching Cashback SBI card.

Sid

SBI launched a 5%cashback card just today. It looks very promising as there are no merchant restrictions.

Yes, too many conditions making it unatractive. Had a third party provider offering the HDFC card, just didn’t feel its worth it. BTW, what do you think of the new SCB Ease My Trip card? Again, not sure they planned it all that well.

Is it same for HDFC’s indigo ka-ching card?

Hi Sid,

You can add one more important point. Both the issuing bank don’t provide a second card.

So why would someone have this card over other regular cards?

Kotak does, my Indigo card is 2nd one.

One strange thing. I am holding Infinia card and my netbanking is showing regalia and 6e reward XL card as upgraded options from Infinia :–) Also there was an automated IVR call asking me to to upgrade to REGALIA from INFINIA :–) Seriously !!!!!! Any other Infinia holders also else also see such options or received such calls?

It means they are gonna severely downgrade Infinia 😄

Looks like you are getting super privileged treatment from HDFC… 😀

I got option for Diners black and ka ching 6E xl as upgrade option from infinia.

I think it is time to redeem all points before they decide to devalue them as well . You never know.

LOL, true.

My DCB it shows Diners Privilege and 6E XL. Luckily none for Infinite 😛

I was considering this card. But ultimately, the absolute slap in the face was that this card gives you 50% off on the convenience fee when booking on Indigo.

The problem? Their card. Their website. And they don’t even waive off the full convenience fee? Felt poorly thought out.

Anyone received cashback for this offer? I have not received and not followed up

Hopeless Kotak Ka ching credit card , none of the benefits can be available easily super expensive. Plus the customer care isn’t able to help at all

Worthless! Scam credit card don’t go for it

Same reviews for hdfc ka ching

Holding this card from 4-5 months

Still don’t get any free ticket which they promised. Also rewards will not be credited immediately after completing flight booked via Indigo as well…

Hi held the HDFC XL card. Same experience as stated. If I remember correctly they also limit the points you can redeem per trip. Closed the card.