Yesbank decided to devalue the reward rate on all of their credit cards, including premium & super premium credit cards that are one of the best in the industry at the moment, sadly no more. The changes will go live from 15th April 2019 and here’s everything you need to know about their most popular variants,

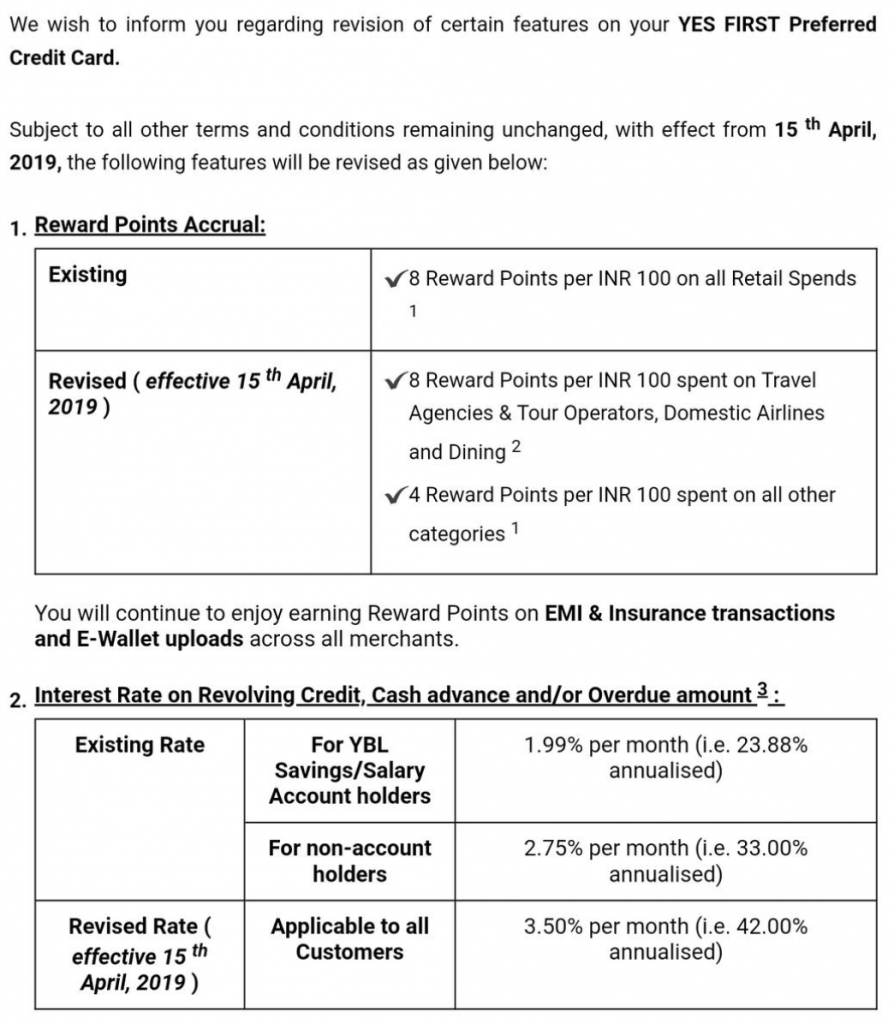

Yes First Preferred

- Current Earn Rate: 2%

- Revised Earn Rate: 2% on Travel, Domestic Airlines, Dining | 1% on all other spends

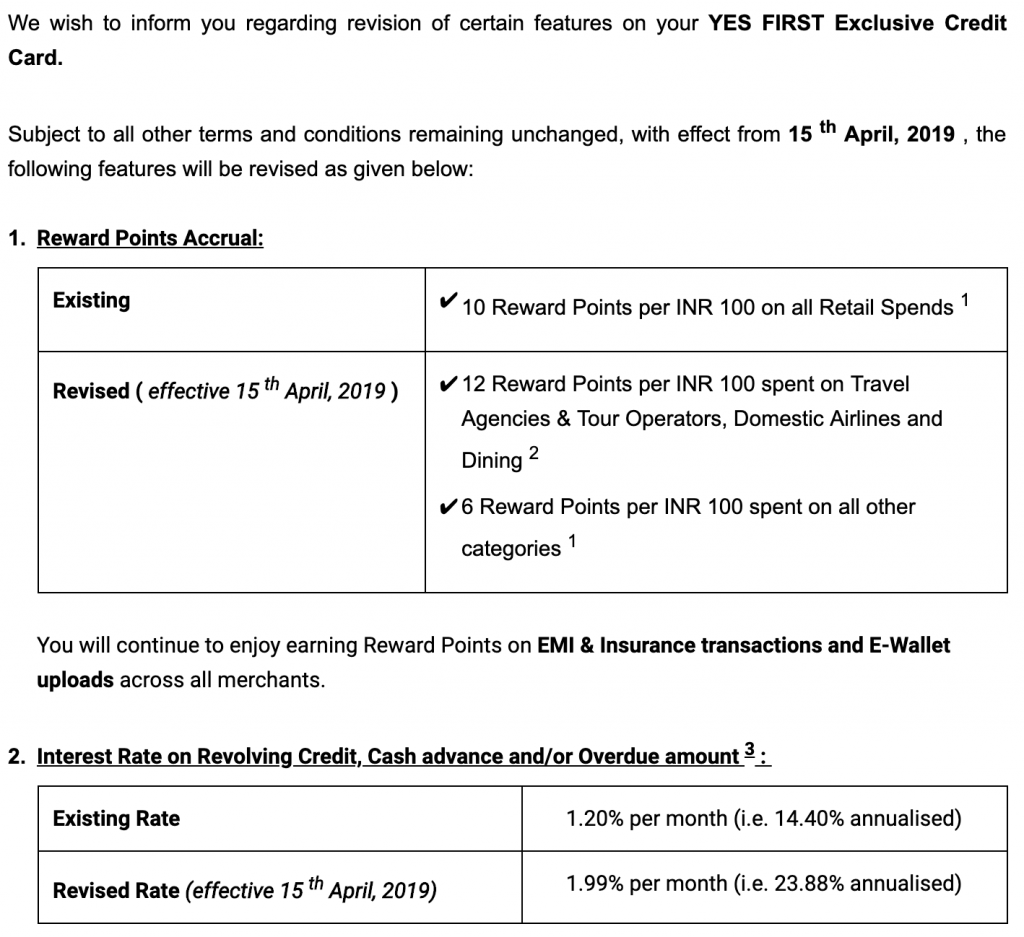

Yes First Exclusive

- Current Earn Rate: 2.5%

- Revised Earn Rate: 3% on Travel, Domestic Airlines, Dining | 1.5% on all other spends

Apart from the reward rate, there are also some changes happening to the interest on revolving credit as you see above. It shouldn’t matter for most as anyway you can convert to EMI at better rates.

But the major hit is on regular spends. I wish at-least they had considered online spends/offline apparel shopping for higher rewards. Anyway, this is what we’ve for now.

Remember, this also affects the international txns as the reward rate no longer helps to cover the markup fees.

Bottomline

This is definitely a shocking news, especially when Yesbank already stopped their aggressive promos since past 1yr. Maybe the next move would be to cut the lounge access on Exclusive as they were upgrading 100’s of Yes First preferred customers to Yes First exclusive overnight.

I assume these changes are happening due to the issues the Bank is facing at the moment. Or, maybe less likely because this could also be a planned move to get some market share initially.

With this change going live, Yes First Credit Cards are no longer useful for majority of users. Though, if Yesbank want’s to gain trust back, they may do so by running their most popular 2x/3x promos which will fix the missing points and even some more.

That all aside, it looks like their Yes Private credit card is so far safe from this impact. So it would make sense if they upgrade select Exclusive cardmembers to Yes Private with FYF atleast.

What’s your take on the changes happening to the reward rates on YesBank credit cards? Feel free to share your thoughts in the comments below.

Hi Siddharth,

I just got the email like 20 mins back and was about to post of YFE article and saw you had already updated. Thanks for the swift dissemination of information!

Sadly with this change the card has lost all its sheen 🙁 and no longer of much use. The rewards rate have been halved! Guess time to explore other cards

Just got the mail on my YFE … Time to give the card some rest after raking in >5 lakh reward points in the last 1.5 yrs … It won’t be the primary card anymore unless they come up with spend based bonus or 2x/5x rewards.

Yes, i received this email too, coincidentally on the same day when my Yes First Exclusive is approved as an upgrade from Yes First Preferred.

Heartbreaking, to say the least. Hope they don’t spoil the party for Yes First Exclusive too.

How did you upgrade from Preferred to Exclusive?

Hi Prashant,

Completed 6 months. Just 5th statement generated. Called Customer care and the upgrade option was available. Agreed. Card generated and visible in Yes bank CC login. Waiting for the physical card.

It had to be as we all here have stopped using the card from long time. This make sc ultimate even better- best back up card to dcb and infinia. The premium customers will shift to sc or hdfc.

A point- even icici amazon credit card is more rewarding now and its available to everyone.

ICICI Amazon Pay is still not available to me.

Seems you have wronged Icici real bad..

Jokes apart… You have icici relationship na..

Hey Prashant

No, Amazon ICICI card is not available for everyone. I am not eligible for SCB ultimate card as per C2C or ITR basis. Should i get other SCB card and after using for 6 months. Can i request for upgrade to Ultimate?

If u have hdfc or any other card try to get the limit upgraded to Rs5l and then apply.

My spends are very high on hdfc regalia. All sorts of txn like offline, online, One EMI and made few forex txn. Still no auto offer on the card.

Got Auto LE in march last year.

looks like sc ultimate is a better option for backup at least for wallet recharge and insurance. their points never expire and probably better redemption option available. I backed out of processing for SC few month ago after applying, bcz of existing yes exclusive.

Well it seems the only reason for keeping Yes First Exclusive is its unlimited priority pass access for primary holder and add on holder.

And when cardholders uses a card only for lounge access, the next round of devaluation will kick in 😀

probably it is already on the table.

Well with this devaluation, this is not gonna be our primary card for us anymore and is as good as dead.

I am happy Atleast used the priority pass access 14 times last month during my honeymoon trip. 😀

Nikhil – 14 times!!

That’s a real honeymoon man😁

Yes Bank copies everything from HDFC and this just a part of it – My thought.

Haha! Rightly said Karthik

Sad news. Recently got upgraded to YFE and now this sad news. I was thinking to make my YFE my primary card, but have to think again.

What other members suggest ? Which card if not YFE ?

I have still to target all time favorite DCB.

SCB ultimate if you are eligible.

What is the eligibility for SC ultimate…I have sc titanium value with limit of 4 lac 31 thousand…can I apply based on this

I have approx 45K spends per month on the yfp card (billpay for insurance and rent payment mostly) and the primary reason was reward points. I am thinking to switch back to using HDFC regalia or SBI simply click cards. Is there any better card than these I could use for my spends? Please suggest.

If you are paying rent best card is SBI prime – pay rent via red giraffe (and get 5% – as it considered as uitility payment)

Rentgirraffe doesn’t sound very secure. A search on the founder shows all talk claims and exaggeration. Only there to suuck pe money. Won’t use just to earn a few points.

I have been using for last 8 months. No problem till now

Have been using RedGiraffe for almost 18 months now… Found it pretty secure and efficient. Paying rent thru YFE has helped me accrue 5lac plus points till date in last 1.5 yrs.

Thanks. I have applied online but dont think they will approve as on my card I does nt show any upgrade available. Any other way J can get the prime card. I have simplyclick

SBI Prime

Unlike HDFC devaluation, there is no urgency to redeem the yes bank rewards points right? Its only reduction in number of rewards points per Rs. 100 .

With new reward rate, is Yes first still better than HDFC regalia?

Sad news on a Friday Eve. I just got this card couple weeks ago and now it all sounds meaningless to me.

I have three cards – YFE (LTF) , ICICI JET Sapphiro (fee paid) and Diners Black (LTF). Use the first two as standby in case Diners does not work. I have been thinking of getting the Vistara Infinite, but was waiting for the international launch and how the product might change. Also, Vistara frequencies from Bangalore are very poor.

Guess time to cancel both YFE & ICICI and look for a new card. Possibly one AMEX (MRCC or Plat Travel) and one Master/Visa.

What was the eligibility criteria for Diners Black – LTF ?

currently having Regaliga First with 5L limit and I guess approx 4 years of default free usgae on the HDFC card.

In 4 years haven’t u got any offer for card upgrade? Check netbanking. Also if no offer, you can send LE form mention which card you like to have with your IT docs.

Atul,

Talk to your RM. Put pressure on them for Infinia & they would settle for DCB LTF :D..Thats what happened with me.

I did not get this email. Hope they have not changed the value of rewards.

Its for all. You’ll receive late maybe. They even designed a nice page for this 😀

link

Hi Siddhart, yes indeed a shocker!

I hold YES Prefered Card today recieved the same mailer from bank. I use to accumulate all my spends on this card due to nice unexpiring points but sadly now I need to shift spending on other card.

Also fortunately I just upgraded to Diners Black now would be happy to put all my spendings on DCB.

OFF TOPIC: Due to think will there be a surprise on devaluation of DCB as well shortly?

It could happen anytime for DCB too. But no one knows!

Yes bank was running fast till last year but now it has become lacklustre.

Laggarding on all fronts

1. No Popular gift ards for redemption like Amazon etc.

2. No Promotions

3. Now Rewards devaluation

I have already stopped using my YFE Card

I have a YFP and not used in the last 2-3 months. It was already devalued when Amazon/Flipkart vouchers were removed and there was absence of the 2/3/5/10X promos. I guess this is the final nail in the coffin. I’m going to close this card (though it is a LTF) once my SC Ultimate Card is approved.

They still have good redemption options like apparel vouchers. But yes with lower reward rate, everything is gone.

P.S. Don’t close it as its anyway LTF. What if they re-start 2x/3x promo 😀

sid better check again. only pvr and reliance digital vocuhers available now. also its not that its not in stock. for debit/saving acc redemption all major apparel n online store are available so pretty clear yes bank is doing it intently for credit card users.

Its still there. Just scroll down.

cant find lifestyle n shopperstop n pantaloon one? am i using wrong browser?

sad news !!!

50% reduction is a hugeeeeee. They might reduce it further just like HDFC did.

Almost everyone in India has HDFC credit card which they can use to book flights from smarbuy which is always much more than Exclusive 3% rewards on travel.

That’s super fast article Sid, got a mail at 6 pm. Thought of posting here and here I see a dedicated article on this.

Time to move on from YESbank..card, bank account and shares too !

Ah yes. I’m stuck with some of their shares too!

Sid,

I am also holding some shares. Waiting for yesbank share to go up a little maybe 400. Will then move out my relationship with the bank

You do trading. Superb…! Start a new website. I can suggest a name. Tradexpert.com….!!!

Well, i’m more into investing than trading (intraday).

Tradexpert is a good idea. I wish i had “2X/3X” hands to get into different verticals 😅

Hi, can you please throw some light on what is the revised reward rate for their Premia version? Thanks!

3 RP per 100 for premia

4 on grocery and dining

There is a para recommending us to use yes first card at domestic lounges and priority pass at international lounges. Can I still use the priority pass at domestic lounges for free?

I’m confused… Documents pickup for YES bank card scheduled for tomorrow. Initially, they offered Preferred, but I insisted for Exclusive, card on card basis (DCB).

Should I submit documents or cancel my application?

Just get it. It’s anyway LTF. We will only know by end of 2019 whether Yesbank will work to fix this or go out of biz!

Devaluation also For YES Prosperity Edge Credit Card.

Greetings from YES BANK.

We wish to inform you regarding revision of certain features on your YES Prosperity Edge Credit Card.

Subject to all other terms and conditions remaining unchanged, with effect from 15 th April, 2019, the following features will be revised as given below:

1. Reward Points Accrual*:

Existing

✔ 6 Reward Points per INR 100 on spends on your Birthday

✔ 5 Reward Points per INR 100 on International spends

✔ 4 Reward Points per INR 100 on Online spends

✔ 3 Reward Points per INR 100 on all other Retails Spends 1

Revised ( effective 15 th April, 2019 )

✔ 4 Reward Points per INR 100 on Grocery Stores & Supermarkets, Department Stores and Dining spends 2

✔ 2 Reward Points per INR 100 on other categories 1

You will continue to enjoy earning Reward Points on EMI & Insurance transactions and E-Wallet uploads across all merchants.

* Effective 15th April, 2019, Reward Points shall be credited to the card account as per below process:-

2 Reward Points per INR 100 on all eligible spends (including Grocery Stores & Supermarkets, Department Stores and Dining) shall be credited as per statement cycle.

Additional 2 Reward Points per INR 100 spent on Grocery Stores & Supermarkets, Department Stores and Dining in every calendar month shall be credited in the subsequent month.

2. Interest Rate on Revolving Credit, Cash advance and/or Overdue amount 3 :

Existing Rate For YBL Savings/Salary Account holders 2.99% per month (i.e. 35.88% annualised)

For non-account holders 3.22% per month (i.e. 38.64% annualised)

Revised Rate ( effective 15 th April, 2019 ) Applicable to all Customers 3.50% per month (i.e. 42.00% annualised)

3. Subject to other features remaining the same, the YES PayNow (Biller Registration) bonus rewards points offer is amended as under:

You will continue to earn 500 Bonus Reward Points on each new YES PayNow biller registration 4 .

Please note:

✔ De-registration of a biller within 6 months of YES PayNow registration will result in reversal of bonus reward points earned for that particular biller registration

✔ De-registration of a biller post 6 months of YES PayNow registration, followed by re-registration of the same biller, will not earn any bonus reward points

You continue to enjoy Best-in-Class features on your YES Prosperity Edge Credit Card:

✔ Earn reward points that never expire

✔ Low Foreign Currency Markup of 3.00% 3 on international transactions

✔ Complimentary Airport Lounge Access:

○ In India: 2 domestic airport lounge visits per calendar quarter through MasterCard affiliated lounge programme

○ International: Complimentary Priority Pass Membership for Primary Cardmember only. All visits will be charged at US$ 27 per person per visit

✔ Annual Bonus of 15,000 Reward Points on spends of INR 6 lakhs or more in every anniversary year 5

In case you need further clarifications, please feel free to call our 24X7 YES Touch Customer Care at 1800-103-1212 or visit yesbank.in.

We assure you of the best of services and hope that you will make the most of your card features and services.

BEFORE

YES FOR YOU!

NOW

NO FOR YOU!

Sincerely,

YES BANK Limited.

I don’t know why they did this. For last one year they were very aggressive in issuing credit cards. I also took yes bank prosperity edge credit card from yes bank as it was lifetime free. Anyways now we have to see what other steps they might me taking after this.

Are you going to update your list of best credit cards after this?

Definitely. Need to update a lot of articles including best of 2019. Will do shortly.

I had just applied for Yes First Preferred and was to submit my documents to the Executive.

With this devaluation, I will just offer the executive a cup of coffee when he visits to collect the documents and bid him bye.

Just missed from ending up with a dud card.

@BGL

As Sid said above, and i wd agree, take it if you are getting it LTF. YFP can be upgraded fast to YFE (LTF).

Pls update about yes first business credit card.

In fact Yes has already upped the ante if their sales push is concerned. In NCR over the last couple of months could see Yes CC executives even outside corporate offices with freebies for Card ! They were even calling old credit card leads for Card creation, Guess they were prepared for this, the last push before the big slide. Given their small CASA base and SME focus; retail is never their forte, very few successful business lines. Hereon the big spends on their cards will go away , and Yes will take out the lounge befits also. FY20 will test these folks , hopefully they can pull some rabbits out of their hat.

I just saw the email in my inbox and have written an email to the bank seeking an upgrade from the Prosperity Edge variant that I presently hold since the Exclusive card rewards travel spends which is what I spend money on month after month. If they decide to decline the request, I would be more than happy to put this card to the back of my wallet where it can get cosy with the RBL card that I got just for those occasional travel offers that go live from time to time.

@Poornith Ninan

I fell laughing, imagining Yes Card getting cosy with RBL.

Just thought how many my cards getting cosy, and new among them would be Yes card.

So true. I replaced it with the SBI Prime Card today. I feel the banks have a strategy of wanting to reduce the reward points awarded to certain spend categories. After all, how much can you spend maximum in a given month a departmental store, grocery store or even at a restaurant.

Here’s where I like the cards such as IndusInd Platinum Aura card wherein you can choose a specific spend category depending on your preference wherein they will give 5X rewards for spends in that particular category.

yes.. highly disappointed with yes bank.

SID pl advice for new options

regards

Amazon pay ICICI card seems much better when compared to prosperity edge now. Already stopped using the card! Not worth anymore to have it other than the domestic lounge access! looking for some good cards for my wife, any suggestions from members, she holds Diners premium, yes Bank prosperity edge.

YES PREMIA Credit Card

Revised (effective 15th April, 2019)

4 Reward Points per INR 100 Grocery Stores & Supermarkets, Department Stores and Dining spends.

3 Reward Points per INR 100 on other categories.

Interest Rate on Revolving Credit, Cash advance and/or Overdue amount.

Applicable to all Customers : 3.50% per month (i.e. 42.00% annualised)

Well, I wouldn’t say I was fully surprised by this move. It was going to happen someday considering how aggressively they were marketing to get new customers onboard. However, I am not that disappointed as most of my spends are travel related and so YFE became better for me 🙂

Also, another significant point to note is that devaluing earn rate is always better than devaluing the points that are already earned which is broad daylight cheating and something HDFC is notoriously known for. In this case, we at least know when the earn rate is going to dip and we can then divert our spends on a better earning card. In the other case, you are forced to redeem the points in a short span just to ensure you don’t lose value on the points already earned.

Couldnt agree more. DCB and YFE should be enough to earn the best rewards rate if used well. Plus they are not devaluating your already earned points.

Hi Sid,

I just got YFP(LTF) card last month as I have yes first saving acccount.

Looking at my exiting cards i.e. Hdfc moneyback and Citi rewards credit card, still YFP is having good rewards. Also I have applied for the Amex Membership rewards credit card through your referral and hoping to use Amex as primary card to milk some points.

how did you go about getting the card, i mean after opening the account, since i too have opened yes first account few days back with 5l funding; what was the process , you got a pre approved offer? what income related documents you gave? can it be only based on high balance in the account for a pre approved offer?

Hi Siddharth

I thought I commented but not visible.

Any suggestions/tips on how to get the YFP upgraded to YFE?

Max limit for other cards is 5lpa. Haven’t spent too high on yes yet TBH as not that beneficial I guess.

Hi Sid,

Somehow the SCB Ultimate slipped under the radar, being a SCB card. Do you think it can be a good replacement for the the YFE?

When are you updating the best card list for 2019 after this downgrade?

By month end.

Do try to include Airline and Fuel category of cards in the same. they also need refresh !

So to hear thta 🙁 got upgrade to YFE. the current statement was first one for YFE.

So sad 🙁 to hear this. I recently got an upgrade to YFE. The current statement was first one for YFE.

It seems that now I should talk my RM to get Diners Club Black, if not Infinia.

Hi Siddarth, Presently i use yes prosperity edge. Its been with me since 1 year and i have a savings account too with them. Infact its just kept in a locker and i prefer to use others like AMEX, REGALIA, ELITE and Premiermiles.

I was searching a way to upgrade to Yes first preferred. However Yesbank doesnt seem to have a upgrade form like Hdfc Regalia. Since the points never expire i just keep accumalating them. Ever since the devaluation the points are pathetic so hopefully an upgrade will bring some points atleast. Thanking you

I spoke to their representative regarding this devaluation. He cited me the example of PayTM. Initially, there were offers and once they captured the market, now not that many offers.

He indicated that Yes bank is also doing the same.

Paytm is market leader in Wallet category, whereas Yesbank has barely 1% market share with 0.75% market share of Transaction Value. Even RBL and HSBC has better market share. What is see here with Yesbank is entering into Cost Optimization phase with reduced marketing budget or may be they are now shifting there focus somewhere else due to change in Management.

I think one cann’t make money out of Card Business, unless it has a greater Market share (like HDFC) or greater share in Value of Transaction (Amex, CITI).

Guys I checked with Yes customer care, international flights booked through yatra, cleartrip, makemytrip, goibibo will continue to get higher reward points (8 for YFP and 12 for YFE) though from direct sites, points would be less.

So this would be at par with domestic travel

In fact for Paytm, I was told that points would remain the same which is a good news. But for other wallets like Amazon Pay, points would get reduced.

Interestingly, I got option to upgrade from YFP to YFE which I readily agreed.

So which one do you think better choice card now – YFP/YFE, Infinia/Diners Club Black, SC Ultimate, …..

hi Ravi,

so, does that mean, even if we add money to Paytm wallet or make a train/bus ticket booking in Paytm, they will be considered for the regular/enhanced point structure for YFP/YFE? These days, I make all my train ticket bookings via Paytm and use my YFP for that, so would be happy to do so going forward as well. Thanks in advance!

Forgot to ask you – you said you were offered for upgrade from YFP to YFE. curious to know how for long were you holding your YFP ? Mine is just 3 months old, have already been making quite a decent spends with that one, was thinking if I should approach Yes Bank for upgrade after a minimum six months or so. Any pointers from your side is highly appreciated. Thanks!

I got upgrade from yfp to yfe.

Start using your card for (no cost )emi on Flipkart n amazon even if you don’t need it.

Thats the only thing i remember done differently this time. Max you pay is gst on interest component.

Bank earns the whole interest component.

I have been told that paytm should give higher points.

There may be possibility that customer care executive may have missed some finer details.

Can you also check so we all can be assured of.

I was holding the YFP for quite some time and have relationship with the bank, probably that could be reason for upgrade to YFE. 3 months seems too less for upgrade.

The phone customer service is not the brightest. I suggest your verify from the email address. Although I received an auto-acknowledgement, I did not receive any reply from their email for a long time.

I don’t think paytm or other wallet will give you 12 rps (3%). Quite sure they should be at 6 rps (1.5%).

Best choice is SCU in terms of rewards (No promotions factored) with Amazon vouchers as redemption.

Just dumped YFE for SCU.

You may be right. Can you also please check regarding Paytm as that is what I was told.

I think best part of YFE is unlimited lounge without any spending criteria like SCB ultimate.

Interested to know if anyone has got ultimate as LTF.

In terms of reward rate, isn’t Icici amazon pay card a good choice ?

Siddharth – we all are waiting for best cards of 2019.

Thanks in advance.

Any one using Yes Bank Saving account?? How is Experience ?

I am thinking close it since it has poor account services and Patetic net banking services ?

Any thoughts?

yes, i am using the yes first saving account. product feature wise its awesome but service is really pathetic.

@ Kinshul

If so then better to close Account with them

i am using it as a secondary account (backup)

I am using their account just to get 6% interest. Service is more or less fine. No issue faced with net banking.

Using YFP from 2017. After receiving their mail, I called customer care to upgrade to YFE but they refused.

Though Diners Black is my primary card, I was using this card as points system was good. Now, I need to look for another card. Any suggestions please.

Will start using the existing free SCB Titanium card for all petrol spends.

To my surpise, I got the message to upgrade from YFP to YFE. I have barely used this card recently since they removed AZ vouchers. I just use it as a backup card.

Called CC and he told me there offer to increase CC Limit, but then I told him I have received the request for the upgrade, he checked and confirmed there is offer. I confirmed it would be LTF like my YFP and he said Yes. Told him to proceed with the upgrade.

There CC is pretty average and needs a lot of time to explain and confirm things, like SC which has professionals.

Thanks,

Datta

Called CC this Sunday, to know if there is a upgrade for my YFP. They said it is there and they offered 25% LE as well. Grabbed both. Recieved the LTF YFE card yesterday in 3 days.

Please guide me more about those Complementary Golf Programs with certain Debit/Credit Cards give.

The following are the TnC’s.

World Mastercard cardholders can enjoy the following privileges:

1. 4 complimentary rounds of green fees per calendar year (not more than 1 round in a single calendar month)

2. 12 complimentary golf lessons per calendar year (1 lesson per calendar month)

3. Discounted golf services at 50% of the green fee beyond complimentary sessions

Now, are these Golf rounds absolutely free or are there any hidden charges? What is this green fee concept?

Also. if i want to take golf lessons (1 free per month), do I need to pay anything extra?

Also, my card entails me for 1 golf round and 1 golf lesson per month, does this means that I can play golf twice a month?

Has anyone actually ever availed golf rounds? Please share your experience.

Anyone?

I am no expert in this, but I have used these golf services occasionally

1) yes, these Golf rounds are free. Green fees is the fee that the golf course charges you to play a game of 18 (or 9) holes. However, if you dont have a golf club set, you will have to rent one (at some cost). Also if you want to hire a caddie, that will be charged.

2) If you take lessons, an instructor meets you and instructs you for some time (say 20 minutes). They rent you a golf club appropriate to the lesson (like a driver, wedge or putter) and give you a basket of balls for free. You can then practice the lesson for next 40~50 minutes.

3) The golf rounds and golf lessons are separate. So yes you get 1 golf round and 1 golf lesson per month.

4) However without a couple of lessons (or more, YMMV), playing golf rounds may not be fun. Also, lessons in a group are more fun than individual lessons. I believe a group of more than 4 might not be allowed in lessons. From my experience, these sessions are more about giving you a flavor of the sport and entice you to learn the sport properly and/or take up membership. Else one can always treat it as an occasional picnic with a short road trip (at least the eligible golf courses in Bangalore are not close to the city, if not very far) and have some fun in a group.

Feel free to ask more questions!!

is there any offer for add on card application , there was some offer like get 2000 points for add on card application

now its time to dump YFE .. upgraded from regalia to INFINIA

@Alein congratulations man for the upgrade to YFE.

I have some questions for regarding YFP.

1. From when you are using YFP and what was your card limit.

2. How much you spend and what is your spending pattern.

3 What other relationship you have with Yes Bank.

Please answer the above questions, it will help other6 YFP member to upgrade.

Hi Siddharth,

Now that Yes Bank Exclusive has been de-valued would it make sense to start using my HDFC regalia again?

Between the two – which would be more beneficial.

Thanks Savio

Got message for upgrade from YFP to YFE. customer care executive said that the card should arrive within 7 working days. However, my application for SBI Prime got rejected saying that I am not eligible. No idea why.

The main reason I have opened yes bank account few days back was to get yes first exclusive now with the devalue is it worth to get it. I currently have an upgrade to diners black and I am waiting for April 1st to know the changes in 10x points. If hdfc removes 10x completely is it worth to get a paid diners black. Currently using regalia ltf. Also now I have doubt that yes bank would remove unlimited Airport lounge after 31st December 19 for yfe card. Sbi is ready to give any card but all are paid cards. Also no reason for me to have yes bank saving account if I don’t have cc. Also is it worth to open 3 lakhs fd with yes bank to get YFE card at this point of time?

Is it good to apply for YFP card (LTF) after the revaluation? Any suggestions please?

If u r getting it LTF there’s no harm. 1.75% FCY markup is lowest or one of the lowest as far as Credit Cards are concerned.

Occasional Yes bank offers also can be covered. Priority pass is still valuable.

I got my YFP in sep 2018, now i hold YFE LTF after upgrade, so i can get Add on Priority Pass with unlimited complimentary visits, with no pressure to pay annual fee or meet spend based targets.

If u have these benefits u may skip, but i don’t know any other major CC that u can get LTF with such low FCY markup, may be others here can also help.

This was one of the best cards in the market in terms of rewards. Sadly, no more… I have stopped using it , and switched to SBI Prime…

Sujit,

I too hold YFP, stopped using this card and switched to prime + regalia

Yescards will be further more devaluate foe sure. The amount of cards they are issuing too saving a/c holders is insane!

I am only holding this card as it is given LTF and in future if they bring any good card to their lineup so i can switch/upgrade to.

Regards

Himanshu

Sujit – Does SBI prime gives reward points on wallet loading?

As far as I know, only Amex and yes credit cards give points on wallet loading.

Anybody having views on this, please suggest.

Citi PM card gives points on wallet loading

Even SC gives reward for wallet based transactions.

Only hdfc wont give pts on wallet loading. Rest all do. Why so much confusion?

all card give wallet loading pointts, except HDFC cards

Hi sid,

Didn’t get any mail from yesbank on this, but they confirmed on cc, no upgrade from preferred to exclusive though I spend at least 30k every month on all monthly transactions due to rewards.

I have StanChart SuperValue (petrol n mobile bills —5% – LTF), manhatten(departmental-5%-LTF), and lifestyle platinum. Citi premiermiles (bigbasket mainly after I took yesbank cc, – 1k per year), HDFC regalia (LTF – all insurance premiums), axis my choice (Grocery n dining – 5%, 250per year), SBI simply Save (spend based offer – free to date), Amex MRCC (LTF – rarely used), ICICI amazon pay(LTF-5% off on amazon)

I am able to use on segments due Samsung pay having all these cards, I just carry yes bank credit card as backup

Please suggest any upgrades, changes to my spending behaviour 😊

hi,

you have amex MRCC as Life time free?

Regards

Pradeep

Yes. Even I have MRCC as LTF.

They had a promotion 2.5 years back to get this card LTF if your annual income > some x amount.

I got this message…. “Now, earn Reward Points on your Rent Payments through YES BANK Credit Card. Also, get Rs. 1,000 Amazon voucher on RentPay Autopay registration and payment through YES PayNow. Valid till 31st Oct’19. T&C ”

Did anyone try rent payment via yesbank credit card? How was your experience?

I tried rent payment through redgirraffe using Yes Credit card and it is good

Thanks @Mouli.

Hi Sid

By dining, what all does Yes bank cover???

SWIGGY, ZOMATO, hotel restaurant? Any idea???

Hye guys.! How are you spending your RPs on Yes Bank cards? I have about 1.18L points in my Yes bank preferred.

There are no good vouchers available. Is it advisable to get Vistara Miles?

You could try voucher like croma or reliance digital or some others which are available. But you’ll get them only after lockdown is over. As they need to be couriered.

You can also donate the points to PM cares fund.

Bro! Done my part in economy by paying salaries to all 50 of my staff. Now looking to reap some benefits from points i earned in an year. 😀

I was collecting them to redeem for amazon vouchers.

Can anyone advice if getting vistara miles is good or should i get the Croma or reliance digital vouchers after lockdown?

Nikhil,

Not sure whether Vistara miles is a right option that too in these tough times specially for Aviation sector

If you are from Delhi and not having any other cards to get Vistara miles then you can go for it

Hey,

I am from Delhi and have lots of other cards, even have Diners Club miles which gives 1:1 on miles. But seeing rewards from past few months, I was thinking to go for mile redemption and end it for once and for all.

Do you think good redemption options will come up and I should wait?